Payment Gateway Fees Calculator

What is a Payment Gateway?

A payment gateway is a technology used by businesses to accept credit card and other digital payments from customers. It acts as a bridge between a customer’s payment method (like a credit card) and the merchant’s bank account, securely transmitting transaction data for processing.

Who Needs a Payment Gateway?

Payment gateways are crucial for:

- eCommerce Businesses: Selling physical or digital goods online.

- SaaS Companies: Managing recurring subscriptions.

- Freelancers & Creators: Selling services or digital products.

- Nonprofits: Collecting donations online.

Types of Payment Gateways

Hosted Gateways

Redirect customers to the provider’s page for payment processing (e.g., PayPal).

Self-hosted Gateways

Allow businesses to handle the payment process on their own site (e.g., Stripe).

API/Integrated Gateways

Provide APIs to integrate payments directly into the website or app (e.g., Paddle).

Localized Gateways

Cater to specific markets or regions (e.g., Mollie).

Payment Gateway vs. Payment Processor

While the terms are often used interchangeably, there’s a distinction:

- Payment Gateway: A service for securely transferring payment data between the customer and the payment processor.

- Payment Processor: Facilitates the transaction by communicating with banks to approve or decline payments.

Think of the gateway as the “messenger” and the processor as the “executor.”

Popular Payment Gateways

Stripe

Supported Countries – Stripe operates in over 45 countries, including the US, UK, Canada, Australia, and most of Europe.

Supported Industries/Best Suitable For – Stripe is ideal for SaaS companies, eCommerce businesses, and subscription-based models.

Setup Fees – Stripe has no setup fees. It charges a per-transaction fee (e.g., 2.9% + $0.30 in the US).

Lemon Squeezy

Supported Countries – Lemon Squeezy is globally available, focusing on simplifying payments for creators.

Supported Industries/Best Suitable For – Best for digital product creators and SaaS businesses.

Setup Fees – No upfront setup fees. It charges 5% + $0.50 per transaction.

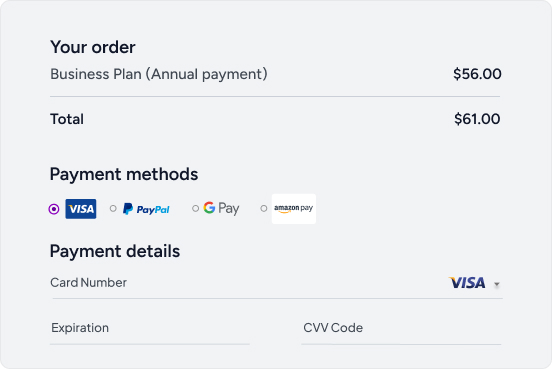

Paddle

Supported Countries – Paddle supports businesses globally but focuses on SaaS and digital goods in Europe and the US.

Supported Industries/Best Suitable For – Tailored for SaaS companies and digital product sellers needing subscription management.

Setup Fees – No setup fees. Paddle takes a revenue share, typically starting at 5% + $0.50 per transaction.

PayPal

Supported Countries – Available in over 200 countries, making it one of the most widely accepted gateways.

Supported Industries/Best Suitable For – Ideal for freelancers, small businesses, and online marketplaces.

Setup Fees – No setup fees, but PayPal charges 2.9% + $0.30 per transaction (varies by region).

Gumroad

Supported Countries – Operates worldwide, though payouts may vary based on location.

Supported Industries/Best Suitable For – Perfect for creators selling digital products like eBooks, courses, and art.

Setup Fees – No setup fees. Gumroad charges 9% + $0.30 per sale for new sellers, with reduced fees for high-volume accounts.

Mollie

Supported Countries – Primarily serves European businesses, with support in countries like the Netherlands, Germany, and France.

Supported Industries/Best Suitable For – Great for local businesses, European eCommerce, and subscription-based services.

Setup Fees – No setup fees. Mollie charges transaction fees based on the payment method (e.g., €0.29 for cards).

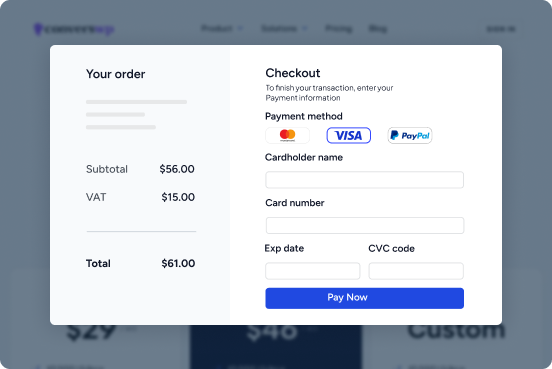

Choosing the Right Payment Gateway

When selecting a payment gateway, consider:

- Geographic Coverage: Ensure the gateway supports your target regions.

- Industry Fit: Look for features that align with your business model.

- Costs: Factor in transaction fees, setup fees, and currency conversion rates.

- Ease of Integration: Choose a gateway compatible with your website or app.

Payment gateways are the backbone of online commerce. By understanding their features and capabilities, you can choose a solution that drives your business forward while ensuring a seamless checkout experience for your customers.