Key Takeaways

Key Takeaways

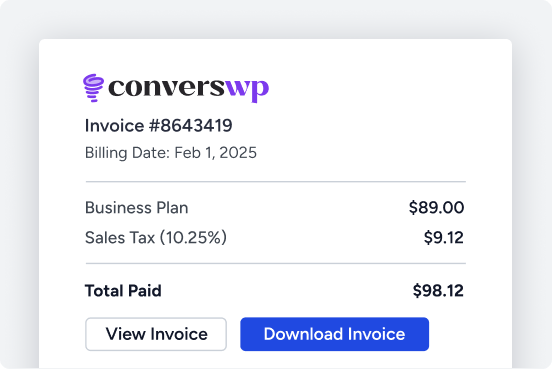

- Invoice Drafting Feature: This feature in Paddle allows for the easy creation and dispatch of invoices to customers, essential for maintaining accurate financial records

- Failure to provide these can result in legal penalties, making their maintenance crucial for both tax return filings and proof of transactions in the event of audits

Navigating the complexities of tax compliance can be daunting for any business owner, especially when managing an online store. As regulations evolve and jurisdictions differ, the pressure to stay compliant is ever-present. That’s where the integration of Paddle with WooCommerce becomes not only beneficial but essential.

Paddle is a versatile payment platform designed to handle sales tax automatically, simplifying the process for WooCommerce merchants. By leveraging its features, businesses can streamline their tax processes, ensuring compliance while focusing on growth.

This guide aims to walk you through the installation and setup of Paddle, highlighting the powerful tax compliance tools available within the platform.

Whether you are new to WooCommerce or looking to optimize your existing setup, this article provides a step-by-step approach to integrating Paddle effectively.

From understanding tax features to managing invoices and subscriptions, you will gain practical insights for maintaining compliance in various regions.

Overview of Paddle and It’s Benefits

Paddle offers a seamless payment solution for WooCommerce and Easy Digital Downloads, enabling users to integrate its payment gateway with minimal setup.

This platform automates tax calculations, ensuring compliance across various industries without extra coding or developer help, which is particularly beneficial for those lacking tax expertise.

With Paddle’s all-in-one solution, managing SaaS payments, billing, and sales tax compliance becomes simplified, making it ideal for businesses aiming for international expansion.

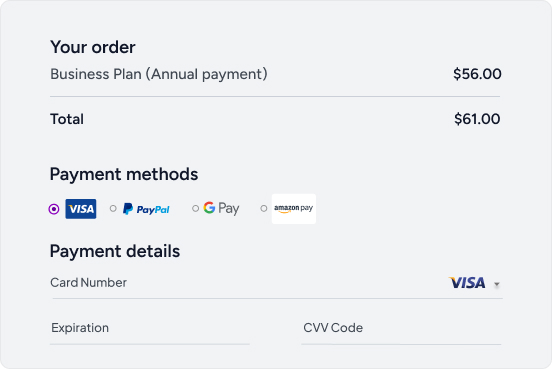

Paddle’s transparent fee structure, charging 5% plus $0.50 per transaction, removes the hidden fees typically seen with other platforms, providing clear cost expectations.

Paddle supports a wide range of payment methods, including major credit cards, PayPal, Apple Pay, and wire transfers, thereby enhancing convenience for customers. This broad array of payment options can improve conversion rates by catering to diverse customer preferences.

Key Benefits of Paddle:

- Automated tax compliance across niches

- Simplified international expansion

- Transparent fee structure: 5% + $0.50 per transaction

- Supports major credit cards, PayPal, Apple Pay, wire transfers

Overall, Paddle’s comprehensive features make it an attractive choice for businesses handling digital products, subscription payments, and seeking secure payment processing.

Installation Process of Paddle with WooCommerce

Integrating Paddle with WooCommerce can streamline your payment processing, making it easier to manage both one-time and subscription payments on your WordPress site. Paddle’s all-in-one solution simplifies tax compliance, while its wide range of supported payment methods can enhance customer satisfaction and potentially boost conversion rates.

Follow the structured steps below to successfully set up Paddle with your WooCommerce store.

Pre-requisites for Integration

Before you begin the installation process, ensure you have the following prerequisites:

- Paddle for WooCommerce Plugin: This must be purchased and installed separately to enable payment processing for both digital and physical products on your website. The plugin facilitates seamless integration with WooCommerce, supporting recurring and subscription billing through existing WooCommerce features.

- Installation Method: You can install the plugin via the WordPress admin area by uploading the Paddle for WooCommerce Plugin, or manually through FTP for greater control.

- Plugin Activation: After uploading, activate the plugin to utilize its features. You’ll then need to navigate to WooCommerce > Settings > Payments to enable the Paddle gateway option.

- Configuration Requirements: Enter critical settings such as the Paddle Vendor ID, Auth Codes, and Public Key to ensure a proper and secure integration process.

- Multi-Site License Plan: If you plan to use Paddle across multiple WordPress websites, consider opting for a multi-site license plan that best suits your needs.

Initial Setup of Paddle in WooCommerce

Setting up Paddle for your WooCommerce store, whether you are selling digital or physical products, starts with the purchase and installation of the Paddle for WooCommerce Plugin. This plugin is not included with your WooCommerce setup and must be purchased separately. Here’s a step-by-step guide to help you through the initial setup process:

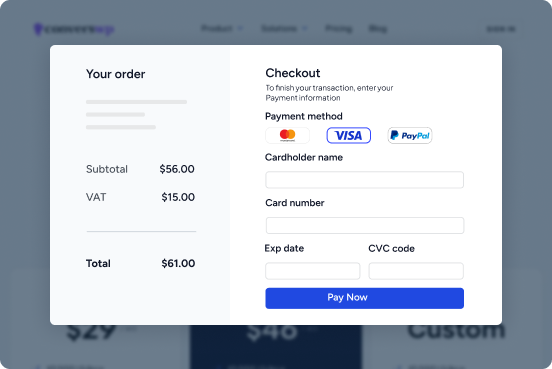

- Purchase the Plugin: The Paddle for WooCommerce Plugin is available at an early bird price of $89 for a single domain license. Multi-site license options are also available.

- Install the Plugin:

- Through WordPress Admin: Navigate to your WordPress admin area, go to ‘Plugins’ > ‘Add New’, and upload the purchased Paddle for WooCommerce Plugin file.

- Manual FTP Upload: Alternatively, use an FTP client to manually upload the plugin files to your WordPress plugins directory. More details about Installation Guide.

- Activate the Plugin: Once the plugin is installed, activate it from the Plugins menu in your WordPress admin area.

- License verifications: To verify your Paddle for WooCommerce plugin license, go to WooCommerce > Paddle Payment after activation. Enter your valid license key in the License Activation section and click Activate License. If the license is valid, the section will turn green and show “Active”; otherwise, an error message will appear. More details about License verifications.

Configuring Paddle Settings

After successful installation and activation, configuring the Paddle settings is crucial to integrate Paddle with your WooCommerce store seamlessly. Here are the key configuration steps:

- Access Payments Settings: Go to WooCommerce > Settings > Payments and enable the Paddle payment gateway.

- Input Required Settings:

- Paddle Vendor ID: Enter your unique Paddle Vendor ID.

- Auth Codes and Public Key: These can be found in your Paddle account. Ensure you input them correctly.

- Checkout Preferences: Decide between a popup or Paddle checkout for your customers.

Connecting Paddle to Your WooCommerce Store

Completing the connection between Paddle and your WooCommerce store involves ensuring all settings are properly configured to facilitate smooth and secure transactions. Here’s how to ensure everything is set up correctly:

- Enable Paddle in WooCommerce: After configuring settings, ensure Paddle is enabled under WooCommerce > Settings > Payments. This step activates Paddle as a payment gateway option on your store.

- Payment Methods Support: The integration supports a variety of global payment methods. Ensure that settings align with your target market to benefit from transactions through credit cards, wire transfers, and other payment methods within the Paddle platform.

- Test the Integration: Before going live, conduct a few test transactions to ensure the entire checkout process works seamlessly from a customer satisfaction perspective.

In conclusion, setting up Paddle for your WooCommerce store involves straightforward steps for purchase, installation, and configuration.

By following this detailed guide, you can efficiently manage the tax implications and secure payment processing associated with both digital and physical products.

Understanding Tax Compliance Features in Paddle

Paddle simplifies tax compliance for WooCommerce store owners by handling all sales tax payments and filings, ensuring you meet state and federal tax regulations. More details about integrate VAT ID with Paddle.

This process removes the complexity of managing taxes, even if you’re not a tax expert. Once sales taxes are paid, Paddle provides a reverse invoice to help you record these payments accurately.

To further ease tax compliance, Paddle allows you to configure subscription plans with country-specific pricing. This feature ensures tailored tax compliance based on regional economic factors, supporting both digital products and physical products.

Paddle ensures accurate tax handling from the start by manually verifying the taxable category for new accounts. This crucial step links tax management directly to the subscription plan setup, making it intuitive for businesses.

Key Features of Paddle’s Tax Compliance:

- Automated sales tax payments and filings.

- Reverse invoices for accurate tax recording.

- Country-specific pricing for subscription plans.

- Manual taxable category verification for new accounts.

By leveraging these tax compliance features, your WooCommerce store can focus on enhancing customer satisfaction and increasing conversion rates, without the headache of tax management.

Managing Taxes within WooCommerce

Managing tax compliance for your WooCommerce store, especially within the European Union (EU), is a critical aspect of ensuring lawful operations. WooCommerce offers robust tools to facilitate the handling of Value-Added Tax (VAT) across various regions.

Proper setup includes applying VAT rates and configuring regional variations, which are crucial for adhering to local regulations and avoiding legal complications. One effective method to integrate payment processing while managing tax collection needs is through plugins like Paddle.

By automating accurate tax calculations, including VAT, WooCommerce helps maintain healthy business margins, making effective tax management a key priority.

Setting Up Tax Classes

When setting up your WooCommerce store, configuring tax classes accurately is essential to ensure precise pricing. By setting the tax-inclusive price during product creation, you guarantee that the correct taxes are accounted for from the outset.

By default, guest users will see taxes applied to the store’s address if the tax settings are properly configured. For logged-in users, taxes are calculated based on their shipping locations as long as tax settings for their region are correctly established.

Some jurisdictions mandate that taxes be charged on shipping fees, which must be included during the tax configuration process. Utilizing plugins such as Paddle can automate these tax calculations, including filing sales taxes, to streamline operations and enhance compliance.

Creating Tax Rates

To correctly apply tax to a product in WooCommerce, it is vital to select the ‘Charge Tax’ option during the product creation process.

Tax settings accessible through the EasyStore settings allow for the addition of applicable taxable regions. It’s imperative to ensure regional tax rates comply with local tax laws, often requiring consultation with local tax authorities to verify the correct rates for customers.

Given the geographical variance, such as in different states or provinces, these regional taxes must be accurately charged based on customer location.

Paddle simplifies tax calculations by automatically managing it when setting up subscriptions, applying specific taxable categories assigned per plan, further easing the burden of exact tax management.

Leveraging Paddle for Invoicing

Leveraging Paddle for invoicing can streamline your WooCommerce store’s billing process. Paddle’s invoicing feature allows for the automatic drafting and sending of invoices, integrated seamlessly with subscription payments.

One of the key benefits of Paddle is its ability to generate invoices in multiple currencies such as USD, EUR, and GBP. This flexibility accommodates a wide range of customer payment preferences and enhances customer satisfaction.

The Paddle VAT Invoice Add-on takes compliance a step further by automatically creating VAT-compliant invoices. This saves time and ensures adherence to tax regulations for every transaction. Additionally, Paddle allows for the customization of invoices to reflect your brand’s aesthetics, promoting professionalism in customer communication.

Furthermore, Paddle’s automated tax payment system manages sales tax based on customer location. It ensures compliance and even generates a ‘reverse invoice’ for record-keeping purposes.

Here’s a quick breakdown of Paddle’s invoicing features:

| Feature | Benefit |

|---|---|

| Automatic Invoicing | Streamlines billing, integrated with subscriptions. |

| Multi-currency Support | Accommodates various customer payment preferences. |

| VAT-compliant Invoicing | Ensures compliance with tax regulations. |

| Customizable Invoices | Enhances brand image and professionalism. |

| Automated Tax Payment System | Ensures compliance with location-based sales tax. |

Leveraging these invoicing features can significantly improve your checkout process and customer service experience.

Subscription Management with Paddle

Paddle operates as a merchant of record, expertly managing all aspects of subscription billing, including secure payment processing, invoicing, and tax compliance.

It’s designed to simplify subscription management for online business owners and SaaS providers, enabling easy integration with platforms like WooCommerce and WordPress.

With Paddle’s payment plugin for WordPress, customers can complete purchases in their preferred payment methods and currencies, supporting a wide range of global transactions.

Key Features of Paddle Subscription Management:

- Payment Processing: Handles secure transactions across multiple foreign currencies.

- Tax Compliance: Alleviates the complex tax implications associated with subscription billing.

- Invoicing: Streamlines billing features, ensuring seamless, compliant invoicing for digital and physical products.

- Integration: Offers easy integration with WooCommerce and WordPress through compatible plugins.

This effortless setup allows business owners to focus on growth and customer satisfaction, free from the burdens of customer service related to billing and compliance.

By supporting multiple currencies and simplifying subscription payments, Paddle presents a compelling choice for those looking to expand into international markets and achieve consistent income across diverse target markets.

Regional Tax Settings and Compliance

Tax compliance is a crucial aspect of managing a WooCommerce store, particularly when expanding into different geographical regions.

Regional taxes are applied based on specific geographical areas, such as states or provinces, ensuring adherence to local tax laws. The application of accurate charges based on customer locations is vital to maintaining compliance and avoiding legal issues.

Paddle simplifies this process by automating sales tax payments according to customer locations, which helps to streamline the checkout process, improve customer satisfaction, and ensure compliance with various transaction types.

Understanding Different Tax Jurisdictions

Managing tax compliance within different regions, like the European Union (EU), is paramount for eCommerce businesses. The EU requires adherence to local regulations when selling to its customers.

EasyStore, for example, offers a solution for setting up and managing Value-Added Tax (VAT) across all EU countries, facilitating accurate tax rates.

Paddle further streamlines this compliance by automating the payment of sales taxes based on the customer’s location, which reduces the burden on businesses by handling the filing and payment of taxes on their behalf.

Paddle’s invoicing system also integrates with subscription payments, ensuring easy management of tax-related documentation, leading to enhanced billing features and improved customer service.

Setting Up Regional Tax Rules

To implement taxes accurately in your WooCommerce store, it’s essential to configure regional tax rules properly. Begin by selecting the Charge Tax option when creating a product.

Access tax settings by navigating to Components > EasyStore > Settings > Taxes, which allows you to manage your tax configurations effectively.

Regional tax rates are defined based on specific geographical areas, such as states or provinces. This helps ensure compliance with local tax laws. For business owners operating in the U.S., understanding the varying state sales tax rates is crucial.

Accurate regional tax application based on either the shipping or purchase location is necessary to avoid compliance issues.

When setting up regional taxes, users can add regions by selecting the required country from a dropdown menu and applying it to their tax settings. Here’s a quick step-by-step guide to help you get started:

- Access Tax Settings: Go to Components > EasyStore > Settings > Taxes.

- Select Charge Tax: When creating a product, make sure to select the Charge Tax option.

- Define Regions: Add regions by selecting the required country from the dropdown menu.

- Consult Authorities: It’s advised to consult with local tax authorities to verify the application of correct tax rates for customers.

These steps will help ensure that your WooCommerce store maintains tax compliance, retaining the goodwill of both customers and local tax authorities.

Best Practices for Tax Compliance

Tax compliance can seem daunting, especially if you’re not a tax expert. When running a WooCommerce store, it’s essential to follow best practices for tax compliance to avoid any legal or financial pitfalls.

One effective way to streamline tax compliance is by using Paddle, which helps automate sales tax processes based on the customer’s location. This solution ensures adherence to local tax regulations without needing manual intervention, thereby reducing the workload and potential for errors.

Selecting the right payment gateway is crucial. It should not only facilitate subscription billing but also ensure compliance with regulatory mandates regarding tax and payment security.

Paddle and other Merchant of Record (MoR) platforms take on legal and financial responsibilities, including tax collection, filing, and compliance, thus easing the administrative burden on sellers.

When dealing with Value-Added Tax (VAT)—especially crucial for eCommerce businesses selling to EU customers—ensuring accurate tax rates and accounting for regional variations is vital.

For businesses operating across multiple channels, it’s important to understand that each channel might introduce additional complexities related to tax compliance that need careful management.

Regularly Updating Tax Rates

Regularly updating tax rates is a fundamental best practice for maintaining compliance in your WooCommerce store. Paddle automates tax payments based on customer location, ensuring tax compliance across all transactions, subscriptions, invoices, and receipts.

- Location-Based Configuration: The Paddle system allows you to configure different shipping tax rates for various locations within the EU. This enables businesses to charge the correct shipping tax based on customer location.

- Micro-Business Exemption: For small enterprises, this exemption allows setting a single shipping tax rate for all shipping activities in the EU, simplifying tax management.

- Product Tax Overrides: These can be applied to certain products to ensure compliance with local VAT regulations.

Using VAT invoices is essential for legal compliance. These invoices help businesses in tracking tax collected and paid, which is crucial for filing accurate tax returns.

Using Reporting Tools for Compliance Checks

Utilizing reporting tools is a critical step in ensuring consistent tax compliance. Paddle automates the sales tax payment process based on customer location, keeping your business compliant without manual tasks.

- Invoice Drafting Feature: This feature in Paddle allows for the easy creation and dispatch of invoices to customers, essential for maintaining accurate financial records.

- Reverse Invoice Issuance: Issuing a ‘reverse invoice’ helps provide a clear record of payables, aiding in efficient tax compliance monitoring across various transactions.

- Legal Compliance with VAT Invoices: Many countries mandate the provision of VAT invoices. Failure to provide these can result in legal penalties, making their maintenance crucial for both tax return filings and proof of transactions in the event of audits.

Overall, organized reporting tools and automated processes like those offered by Paddle can significantly reduce the burden of tax compliance, ensuring your store operates smoothly and legally.

Troubleshooting Common Integration Issues

When integrating Paddle with your WooCommerce store, you may encounter several common integration issues. These can include nondescript errors, particularly when using additional tools like QuickBooks.

Such problems can result in lengthy troubleshooting processes with unclear outcomes. Often, addressing these issues requires multiple attempts and actions, such as uninstalling and reinstalling the plugin, adjusting permissions, and even restarting your computer.

Users frequently experience frustration with unreliable plugins, which can lead to significant downtime for your eCommerce operations and may require technical assistance to rectify.

If all else fails, escalating the issue to your support or development team can be beneficial, though responses might be slow or even absent after initial contact.

When setting up payment gateways like Paddle for WooCommerce, it’s crucial to carefully input specific settings to ensure proper functionality and prevent errors.

Sync Errors between Paddle and WooCommerce

The Paddle for WooCommerce plugin offers the advantage of seamless integration, supporting both one-time payments and subscription billing.

To enable Paddle as a payment gateway, the plugin must be correctly installed and activated. After activation, the option to enable Paddle can be found under WooCommerce > Settings > Payments.

Configuration settings that are essential for a successful setup include the Paddle Vendor ID, Auth Codes, and Public Key.

It is essential to input these details correctly to avoid sync errors. Additionally, if you are managing multiple WooCommerce instances, issues could arise due to the multi-site license plans, necessitating careful management of your sync settings.

Resolving Tax Calculation Discrepancies

Paddle provides automatic handling of tax calculations based on customer location, significantly reducing the complexities of managing sales taxes for your business.

This feature ensures tax compliance across different aspects of payments, subscriptions, invoices, and receipts by filing and paying sales taxes on the seller’s behalf.

Paddle also includes a reverse invoice feature, which can help businesses maintain financial accuracy while managing their tax obligations.

The integration of Paddle with invoicing systems simplifies processes, as it drafts and sends invoices directly to customers without additional effort. Moreover, Paddle comes with built-in fraud protection measures at no extra cost, offering a way to monitor and address any suspicious transactions that may result in tax discrepancies.

By ensuring that your Paddle and WooCommerce integration is properly configured, you’ll be well-positioned to handle these common challenges and maintain a smooth operational flow for both digital products and physical products in your store.

Practical Tips for Business-Specific Tax Handling

Navigating tax compliance can seem daunting, but adopting the right tools and strategies can streamline the process. Utilizing Paddle’s automated tax system is one effective way to manage sales tax complexities, as it calculates taxes based on customer location and handles compliance across various transactions, including payments, subscriptions, invoices, and receipts.

This automation not only simplifies tax management but also ensures accurate reverse invoices for record-keeping, allowing businesses to focus on growth without the constant worry of tax implications.

When setting up products in your eCommerce platform, selecting options like “Charge Tax” is vital to ensuring tax applicability on sales.

Furthermore, platforms like EasyStore facilitate compliance with Value-Added Tax (VAT) requirements in EU regions by allowing you to manage tax rates accurately and adhere to local regulations effortlessly.

It’s also critical to choose a payment gateway that fulfills statutory mandates, such as PCI DSS, to manage customer transactions securely.

Customizing Tax Settings for Digital Goods

For digital goods, setting up tax processes begins with enabling tax-inclusive pricing. This ensures that the prices your customers see already include applicable taxes, providing transparency and potentially enhancing customer satisfaction.

Since tax rates are calculated at checkout based on the customer’s shipping address, accurate tax rates are applied, which is particularly beneficial for digital services offered to an international market.

WooCommerce allows for specific tax configuration settings where you can display tax-inclusive prices, adding to a seamless checkout process and improving conversion rates. For guest users, the tax rate defaults to your store’s location unless set otherwise.

In contrast, logged-in users will see taxes based on their individual shipping addresses, offering a tailored experience. Moreover, adding taxes to shipping fees, as required by local laws, ensures compliance and is vital even when selling intangible items like digital products.

Adapting Tax Handling for Physical Products

For eCommerce businesses dealing in physical products, particularly in regions with VAT systems like the European Union, managing tax compliance is crucial.

Automated solutions such as Paddle’s tax payment system are invaluable as they calculate sales tax based on the customer’s location and manage compliance and filing on your behalf.

This reduces the administrative burden and ensures you’re meeting all statutory requirements.

When creating product listings, always select the option to charge tax to reflect accurate pricing to your customers.

This is especially important for businesses operating across multiple jurisdictions. eCommerce stores must also consider logistics challenges, such as manufacturing, storage, and shipping, all of which can impact tax obligations and compliance.

Therefore, utilizing an automated system not only saves time but protects against potential non-compliance issues that could arise from logistical complexities.

FAQs

VAT Invoices and Their Importance

VAT invoices are crucial for businesses operating in regions where they are a legal requirement. These invoices not only ensure tax compliance but also assist in tracking collected and paid taxes, which is essential for accurate tax return filings.

Maintaining organized records through VAT invoices is vital during audits, proving business transactions and enhancing credibility.

Paddle offers a streamlined solution by automatically handling tax compliance, including filing and paying taxes on behalf of businesses, thus ensuring smooth and compliant transaction processes.

How do I ensure compliance across multiple regions?

Ensuring tax compliance across multiple regions can be challenging due to varying local tax laws. Start by consulting with local tax authorities to apply the correct tax rates to customers based on their locations.

Implement regional tax rates relevant to specific states or provinces to comply with local regulations. Paddle simplifies this process by automating sales tax payments according to customer location, easing the compliance burden.

It also issues reverse invoices to display tax payments on records. Ensure your e-commerce platform can easily manage regional tax rates for accurate tax application.

Can Paddle handle refunds and tax adjustments?

Paddle is designed to manage tax compliance seamlessly, including handling refunds and tax adjustments.

The system automates the payment of sales taxes based on customer location and provides reverse invoices as proof of tax payment. This assists in handling refunds and adjustments effortlessly. Paddle integrates smoothly with WooCommerce, simplifying customer billing and ensuring all transactions remain compliant.

By utilizing Paddle’s automated solutions, businesses can focus on growth rather than the intricacies of tax compliance and refunds.

What should I do if I encounter payment processing issues?

Payment processing issues can disrupt business operations, so identifying specific errors, such as CANNOT_BE_ZERO_OR_NEGATIVE, is crucial. Automated solutions like Paddle can reduce these complexities by managing tax compliance and eliminating administrative burdens.

Ensure your payment processor uses robust fraud protection; Paddle offers four layers of security to safeguard transactions. If payment methods do not load, check plugin settings and compatibility with other plugins.

Familiarize yourself with the technical documentation of your payment processor for seamless integration and efficient problem-solving.

By incorporating these practices and utilizing Paddle’s comprehensive solutions, businesses can navigate tax compliance and payment processing challenges with ease, ensuring both regulatory adherence and customer satisfaction.