Payment gateways have become an essential component for businesses operating online, facilitating secure and seamless transactions between merchants and customers. In this digital age, where e-commerce is thriving, choosing the right payment gateway can significantly impact a business’s success. Two prominent players in this arena are Paddle and 2Checkout(now Verifone), each offering a comprehensive suite of payment solutions tailored to meet the diverse needs of online merchants.

This article aims to provide an in-depth comparison between Paddle and 2Checkout, shedding light on their respective features, pricing structures, integration capabilities, and overall strengths and weaknesses. By dissecting these two platforms, online businesses can make an informed decision and select the payment gateway that best aligns with their specific requirements, ensuring a seamless and efficient payment experience for their customers.

Whether you’re a startup venturing into the e-commerce realm or an established business looking to optimize your payment processes, this comprehensive analysis will equip you with the knowledge necessary to navigate the intricate world of online payments and ultimately enhance your bottom line.

What are Paddle and 2Checkout?

Paddle

Paddle is a robust payment platform that focuses exclusively on providing an end-to-end payments infrastructure tailored for SaaS, software subscription, and digital goods merchants. It excels at handling global sales, including subscriptions, one-time transactions, and complex tax compliance like VAT. Whether you’re a SaaS provider, software platform, or digital product vendor, Paddle offers powerful features and seamless scalability to support your growth.

Key Features

- 5% + 0.50¢ per sale flat rate pricing

- Built-in sales tax compliance for Europe, US, Canada, and Australia

- Localized checkout options across 200+ countries and multiple currencies

- Automated VAT collection, filing and verification capabilities

- Focused subscription monetization tools like metered billing and instant license generation

- One-click instant payouts directly to all major banks globally

- Streamlined affiliate program and partner payout management

- Painless transparent platform pricing with sliding fee scale models

Of course, their comprehensive security standards make the list too – PCI DSS Level 1 compliance, bank-level encryption, extensive fraud protection and high service uptime guarantees.

Best Use Cases

- SaaS Companies: Manage global subscriptions and tax complexities effortlessly.

- Software Platforms: Offer secure and convenient purchasing options for digital products.

- Digital Product Vendors: Streamline sales processes and focus on creating amazing products.

2Checkout (Now Verifone)

2Checkout, now known as Verifone, stands as a leading global digital commerce platform, empowering businesses worldwide to seamlessly engage in online transactions and drive growth. Offering a comprehensive suite of services, 2Checkout facilitates secure payment processing, streamlined subscription billing, efficient digital commerce, and expansive global payments.

Key Features

- Accepts payments in over 200 markets and across 87 currencies

- Offers separate pricing packages for selling, subscriptions and all-in-one features

- Supports multiple payment methods, including credit cards, PayPal, and alternative payments

- Offers a hosted payment page and a customizable checkout experience

- Provides advanced fraud protection and risk management tools

- Enables recurring billing and subscription management

- Offers a range of integrations with popular e-commerce platforms(Shopify, WooCommerce) and shopping carts

- Provides comprehensive reporting and analytics tools

2Checkout offers robust payment fraud management and international compliance solutions, ensuring businesses can scale globally without concerns about fraudulent activity or regulatory compliance. With advanced fraud detection tools and top-tier certifications like PCI DSS and GDPR compliance, they provide reliable global commerce and data security with outstanding uptime.

Best Use Cases

- Software/SaaS: Manage subscription billing and payments for software products effortlessly.

- Online services: Simplify payment processing for digital downloads, memberships, and online consulting.

- Physical goods/retail: Sell retail products online with global payment support and customizable checkout experiences.

Paddle Vs 2Checkout: Features and Functionality

Both Paddle and 2Checkout are feature-rich options in the online payment processing arena, catering specifically to software businesses, digital goods sellers, eCommerce and SaaS companies. They boast comprehensive feature sets to streamline global sales, manage subscriptions, and boost revenue. But how do they compare head-to-head? Let’s take a closer look at their key functionalities:

| Features | Paddle | 2Checkout |

|---|---|---|

| Target Audience | Ambitious online businesses, SaaS providers, software platforms, digital product vendors, WordPress-based eCommerce and digital download businesses (Paddle for EDD and Paddle for WooCommerce) | Wide range of businesses, from small e-commerce stores to large enterprises, across various industries like digital businesses, retail, hospitality, travel, and more. |

| Global Reach | 200+ currencies, localized checkout experiences | 200+ markets, 80+ currencies and display languages, localized checkout experiences in 30+ languages, supports over 45 payment methods in total |

| Subscriptions | Powerful management tools, flexible pricing plans, churn reduction strategies | Subscription billing with features like dunning management, proration, and upgrade/downgrade options (available in higher plans) |

| Tax Compliance | Handles VAT and other regional taxes | Global tax compliance tools and support (available in higher plans) |

| Security | Robust PCI-DSS compliance, advanced fraud prevention, data encryption | PCI-DSS Level 1 compliant, fraud prevention tools, data encryption at rest and in transit |

| Scalability | Handles high transaction volumes, scales with your business | Designed to accommodate high transaction volumes for enterprises |

| Ease of Use | User-friendly interface, but requires some technical knowledge | Offers hosted payment pages and customizable checkout experiences |

| Built-in Marketing Tools | Limited integrations with marketing platforms | Limited integrations with marketing platforms |

| Mobile-First | Mobile-optimized checkout | Mobile-friendly checkout experience |

| Pricing | Transaction fees + potential volume discounts | Tiered pricing plans with transaction fees and monthly base fees (depending on plan) |

| Hidden Fees | None | May have additional fees for features like tax compliance, global payouts (depending on plan) and additional payments for localized payment methods |

| Integrations | More integrations with eCommerce platforms and tools | Extensive integrations with major eCommerce platforms and shopping carts |

| Reporting and Analytics | Robust reporting and analytics capabilities powered by ProfitWell Metrics | Reporting and analytics dashboard with insights into sales, subscriptions, and customer behavior |

| Customer Support | Email supportLive chat supportComprehensive knowledge baseCommunity forumsPhone support (for higher pricing tiers) | Email support (Dedicated support teams for different issues. Ex: Financial support, Chargeback support etc)Live chat support (included in all plans)Comprehensive knowledge baseCommunity forums Phone support (for higher pricing tiers) |

Note: If you’re using Easy Digital Downloads or WooCommerce, consider Paddle for EDD and Paddle for WooCommerce. They offer native integrations and optimized features for those platforms, streamlining setup and maximizing your WordPress experience.

Paddle for EDD

- Targets users of the Easy Digital Downloads (EDD) plugin, a popular platform for selling digital products on WordPress.

- Seamlessly integrates Paddle’s powerful capabilities like global payments, subscriptions, tax compliance, and advanced fraud protection within the EDD interface.

- Provides additional features like automatic license generation, discount management, and one-click payouts, all geared towards simplifying and scaling digital product sales through EDD.

Paddle for WooCommerce

- Caters to users of the WooCommerce plugin, a widely used eCommerce platform for WordPress.

- Connects WooCommerce websites with Paddle, enabling secure and smooth processing of one-time and recurring payments for physical and digital goods.

- Offers features like convenient checkout experiences, international tax handling, and robust subscription management tools specifically designed for WooCommerce environments.

Essentially, both Paddle for EDD and Paddle for WooCommerce leverage the benefits of the Paddle payment gateway but make them readily accessible and enhance their functionality within the familiar interfaces of EDD and WooCommerce, respectively. This makes them ideal choices for WordPress users already comfortable with these plugins and wanting powerful payment solutions without leaving their preferred platform.

Supported Payment Methods

Paddle: Think global citizen here. With over 200 currencies, popular e-wallets like Apple Pay and Alipay, and adaptable local payment methods like SEPA Direct Debit, Paddle embraces your customers’ preferred payment options anywhere in the world. This inclusivity fosters trust and smoothens cross-border transactions, especially in emerging markets.

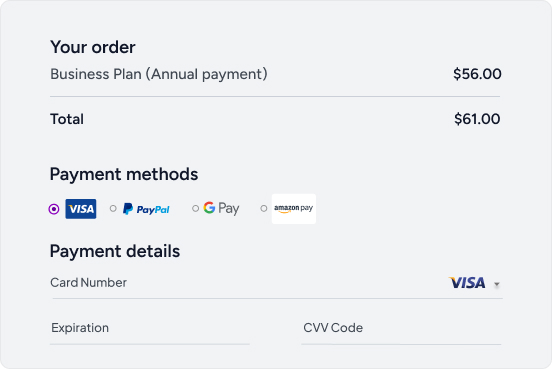

2Checkout: 2Checkout offers a wide range of payment options to cater to global customers. It supports major credit cards like Visa, Mastercard, American Express, and Discover, as well as popular digital wallets such as PayPal, Amazon Pay, and Apple Pay. Additionally, 2Checkout facilitates alternative payment methods like direct bank transfers, cash payments, and regional e-wallets, ensuring that customers can pay using their preferred method. This extensive support for various payment types enables merchants to provide a seamless checkout experience and tap into diverse markets worldwide.

Global Reach

Paddle: Picture borderless commerce at its finest. Paddle enables sales in 200+ countries, complete with localized checkout experiences tailored to language, currency, and cultural preferences. Paddle simplifies international expansion, new product launches and more. This creates a seamless and familiar experience for customers worldwide, boosting conversion rates and brand loyalty.

2Checkout: 2Checkout offers a truly global reach, facilitating transactions in over 200 markets and supporting 87 currencies. Its payment platform provides localized checkout experiences, automatically adjusting to the customer’s language, currency, and payment preferences. This level of customization ensures a smooth and familiar buying journey for customers across the globe. With 2Checkout, merchants can easily expand their businesses internationally and tap into new markets without the hassle of navigating complex regional requirements. By providing a seamless and localized shopping experience, 2Checkout helps businesses increase conversions and build a loyal customer base worldwide.

Currency Conversion

Paddle: Say goodbye to manual calculations and potential pricing errors. Paddle handles automatic currency conversion at competitive rates, ensuring a hassle-free experience for both you and your customers. This removes a technical hurdle and fosters trust in your global pricing strategy.

2Checkout: 2Checkout simplifies currency conversion by automatically handling the process for international transactions. With support for 87 currencies, customers can view prices and complete purchases in their preferred currency, eliminating the need for manual conversions. 2Checkout’s currency conversion rates are competitive, ensuring fair and transparent pricing for both merchants and buyers. This feature streamlines the checkout process, reducing potential barriers and increasing the likelihood of successful conversions, particularly in cross-border transactions.

Fraud Prevention

Paddle: Paddle leverages advanced fraud detection algorithms and machine learning techniques to identify and mitigate potential risks. Their system analyzes various data points, including IP addresses, purchasing patterns, and device information, to flag suspicious activities. Additionally, Paddle offers customizable fraud filters, allowing merchants to define their own rules and thresholds based on their specific risk profiles.

2Checkout: 2Checkout employs robust fraud prevention measures to protect merchants and customers from fraudulent activities. Their advanced risk management tools analyze transactions in real-time, utilizing a variety of techniques such as IP geolocation, velocity checks, and machine learning algorithms to detect and block suspicious behavior. 2Checkout also offers customizable fraud filters, enabling merchants to set their own risk parameters and thresholds based on their business requirements. This comprehensive approach to fraud prevention helps minimize chargebacks, reduce financial losses, and ensure a secure payment environment for all parties involved.

Chargeback Management

Paddle: Paddle takes a proactive approach to chargeback management. Their system automatically responds to chargeback notifications, gathering relevant transaction data and evidence to support merchants’ cases. Paddle also provides detailed chargeback reporting, enabling businesses to identify patterns and potential areas of improvement in their processes.

While Paddle handles the initial chargeback response, merchants are responsible for providing additional documentation or information if needed during the dispute process. Paddle’s knowledge base offers guidance on best practices for chargeback prevention and management.

2Checkout: 2Checkout offers dedicated chargeback support to help merchants navigate the chargeback process. Their chargeback team assists in responding to chargeback notifications, gathering necessary documentation, and representing the merchant’s case during disputes. 2Checkout provides merchants with chargeback reports and analytics, enabling them to identify potential sources of chargebacks and take preventive measures.

Additionally, 2Checkout’s fraud prevention tools and customizable risk filters can help minimize the occurrence of chargebacks by detecting and blocking suspicious transactions. The platform also offers guidance and best practices for merchants to implement effective chargeback management strategies within their businesses.

Reporting and Analytics

Paddle: Dive deep into data-driven insights with rich analytics powered by ProfitWell Metrics. This tailor-made solution for subscription businesses allows you to benchmark key SaaS metrics against industry data, utilize predictive modeling to identify at-risk accounts, and access API pipelines for data-driven decision-making. This eliminates the need for separate analytics tools and empowers you to optimize your pricing, churn reduction strategies, and expansion plans.

2Checkout: 2Checkout provides comprehensive reporting and analytics capabilities to help merchants gain valuable insights into their business performance. The platform offers detailed transaction reports, allowing merchants to track sales, revenue, and payment trends across different products, currencies, and markets. Additionally, 2Checkout provides analytics tools that enable merchants to monitor key performance indicators, such as conversion rates, customer acquisition costs, and customer lifetime value.

Merchants can access real-time data and generate customized reports based on their specific needs, enabling them to make informed decisions about their pricing strategies, marketing campaigns, and overall business operations. The reporting and analytics features within 2Checkout’s platform aim to provide merchants with the necessary data and insights to optimize their payment processes, identify growth opportunities, and drive business success.

Integrations

Paddle: Streamline your workflow with a vast library of integrations covering popular eCommerce platforms, CRMs, marketing tools, and more. This seamless ecosystem allows for automated tasks and data exchange, boosting efficiency and productivity. Additionally, dedicated solutions like Paddle for EDD and Paddle for WooCommerce cater specifically to WordPress users.

2Checkout: 2Checkout offers a range of integrations with popular e-commerce platforms, shopping carts, and content management systems, enabling merchants to streamline their payment processes seamlessly. Some of the notable integrations include WooCommerce, Magento, Shopify, OpenCart, and PrestaShop, among others. These integrations allow merchants to easily incorporate 2Checkout’s payment gateway into their existing online stores, reducing the need for complex custom development.

Additionally, 2Checkout provides API access, allowing developers to build custom integrations and tailor the payment experience to their specific business requirements. While the integration options may not be as extensive as some of its competitors, 2Checkout aims to provide compatibility with widely-used e-commerce solutions to cater to the needs of a broad range of merchants.

Distinct Features of Paddle and 2Checkout

Paddle Features

Flexible Monetization Tools: Paddle makes it easy for SaaS companies to experiment with pricing models and optimize monetization strategies over time. Its metered billing and usage-based pricing features support innovative models like trials, free plans, credits, and more. This flexibility allows businesses to fine-tune their offerings to maximize revenue.

Comprehensive Tax Management: For companies selling software globally, tax compliance is a major headache. Paddle provides complete VAT, GST and sales tax solutions out-of-the-box for Europe, North America, Australia and beyond. This saves teams the pain of managing different jurisdictional rules and filings.

Instant Global Payouts: Paddle offers one-click payouts directly to bank accounts across the world, with daily transaction reconciliation. This level of speed and transparency for global payments is extremely rare in the payments industry. Sellers can access their earnings instantly no matter where they are located.

2Checkout Features

Extensive Payment Options: 2Checkout supports a wide range of payment methods, including credit cards, PayPal, Amazon Pay, direct bank transfers, and various regional e-wallets. This comprehensive support for diverse payment options allows merchants to cater to customers’ preferences across different markets, potentially increasing conversion rates.

Advanced Fraud Protection: 2Checkout employs sophisticated fraud detection and prevention measures, such as real-time transaction monitoring, machine learning algorithms, and customizable risk filters. These tools help merchants minimize chargebacks, reduce financial losses, and ensure a secure payment environment for their customers.

Global Reach and Local Presence: With support for over 200 markets and 87 currencies, 2Checkout enables merchants to expand their businesses globally. Additionally, the platform provides localized checkout experiences, automatically adjusting to customers’ language, currency, and payment preferences, ensuring a seamless buying journey.

Scalability and Enterprise Solutions: 2Checkout is designed to handle high transaction volumes and meet the needs of large enterprises. The platform offers customizable solutions, robust reporting and analytics capabilities, and dedicated support teams to cater to the unique requirements of enterprise-level businesses.

Pricing and Fees

When choosing a payment services provider, one of the most crucial considerations for any business is costs. Between payment processing rates, platform fees, and additional hidden costs, expenses can quickly pile up. In this section, we examine and compare the pricing models of Paddle and 2Checkout.

Paddle Pricing

Paddle offers an all-inclusive, transparent pricing model covering payments, subscription billing, tax compliance, fraud protection, and more under one platform. There are no hidden fees or additional costs.

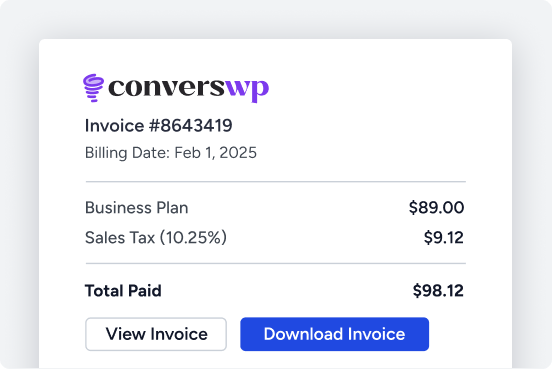

Their pay-as-you-go pricing starts at 5% + 0.50¢ per transaction, delivering essentials like global payments, built-in tax compliance, chargeback protection, and fraud screening.

Paddle provides customized pricing for rapidly scaling or large enterprises to unlock additional premium capabilities like migration services, implementation support, and dedicated success management.

It’s important to note that there are services, Paddle for EDD and Paddle for WooCommerce, that offer customized pricing plans suited for the specific needs of WordPress sites, taking into account transaction volume, subscriptions, and other factors. These services both start at $89/year. For more detailed information visit this link.

2Checkout Pricing

2Checkout offers a tier-based pricing structure, unlike Paddle’s all-inclusive model.

Here are the packages they offer:

| 2Sell | 3.5% + $0.35 per successful sale |

| 2Subscribe | 4.5% + $0.45 per successful sale |

| 2Monetize | 6.0% + $0.60 per successful sale |

The packages 2Sell and 2Subscribe can be used for any type of product. 2Monetize is a package dedicated only for merchants selling digital goods.

Ease of Use and Support

When evaluating a billing and payment platform, it is key to ensure a positive user experience through intuitive interfaces and helpful resources. Both Paddle and 2Checkout have invested in creating intuitive interfaces and providing robust support channels to ensure a seamless user experience.

For Paddle, easy-to-configure billing models, actionable customer insights, tailored gaming monetization features, and localized checkout experiences are top strengths that underpin their commitment to user-focused design principles. Hands-on support and 95%+ customer satisfaction gives Paddle users peace of mind during launch and expansion stages.

Paddle offers a comprehensive knowledge base, community forums, and email and live chat support channels. These resources provide merchants with access to detailed documentation, troubleshooting guides, and direct support from Paddle’s experienced team.

Testimonials from CEOs attribute considerable operational efficiencies and cost savings to Paddle’s ability to minimize billing administration overheads. Access to ongoing revenue metric benchmarking against wider industry subscription data also provides data-driven assistance.

2Checkout understands that merchants may have varying levels of technical expertise. Their user interface is designed to be intuitive for basic setup and management, making it easy to get started quickly. However, for more advanced features like managing global taxes and payouts, you might need some additional help from their support team.

2Checkout offers a robust support system to ensure a smooth experience for its users. This includes email and live chat support, available for all plans, for submitting inquiries and receiving detailed responses. What’s unique about their support is that they have unique dedicated support teams for each kind of customer support issue. They have over 8 such teams for chargeback, refunds etc.

Additionally, they offer a comprehensive knowledge base with articles, tutorials, and FAQs to empower you with self-service solutions. A community forum fosters user connection, allowing you to share experiences and find solutions from the 2Checkout community and support staff. They also provide phone support.

While specific customer satisfaction metrics may not be publicly available, 2Checkout prioritizes user success through their investment in comprehensive support resources and a user-friendly platform designed to streamline onboarding and day-to-day operations for merchants of all technical backgrounds.

Security and Compliance

With payment platforms processing valuable customer data, having rigorous security protocols and compliance with privacy regulations is non-negotiable. We examine how Paddle and 2Checkout stack up on key parameters of trust and transparency for customers.

Paddle offers best-in-class security reinforced through adhering to SOC 2, GDPR standards, undergoing regular pentests/audits, and being PCI DSS Level 1 certified – the most stringent level. Their security portal offers in-depth documentation around policies, procedures, recovery metrics, access control, and development practices.

With AWS cloud hosting, role-based access controls, MFA authentication, and advanced threat monitoring via SIEM systems, they check all the boxes for enterprise-grade security. A dedicated security team and proactive vulnerability disclosure program further underpin their mature posture.

2Checkout secures your customer data with industry-leading PCI-DSS Level 1 compliance and robust encryption. They also use advanced fraud prevention tools and stay compliant with global regulations like GDPR. Regular security audits and transparent communication about their practices solidify their commitment to data security and building trust with your business.

Use Cases and Recommendations

With a detailed analysis of core capabilities, security, pricing, and ease of use behind us – we wrap up with recommendations on ideal customer profiles who stand to benefit the most from Paddle and 2Checkout respective offerings.

Businesses Who Are Best Suited for Paddle:

Given its robust feature set and premium pricing, Paddle shines best for well-established businesses with complex global operations including:

- Mid-market to enterprise SaaS companies earning over $10M+ in revenue

- Gaming studios with 50,000+ users and multi-SKU monetization

- Digital publishers generating high 6-7 figure subscription income

- WordPress-based eCommerce and digital download businesses. Paddle for EDD and Paddle for WooCommerce are tailor-made for these platforms, offering powerful features and seamless integration to help your WordPress site thrive

Specifically, the ability to customize sophisticated subscription billing constructs, executive sales tax calculations across 200+ countries, and tap detailed cross-border consumer spending data make Paddle worthwhile for expanding companies.

Those needing niche accommodations like metered pricing models for API usage, certificate generation for software licenses, or risk management around fluctuating cross-border tax jurisdictions will find that they have unmatched capabilities with Paddle.

Businesses Who Are Best Suited for 2Checkout:

2Checkout caters to a wide range of businesses, from small e-commerce stores to large enterprises, making it a versatile choice for merchants across various industries and scales. Its comprehensive suite of payment solutions and global reach make it particularly well-suited for:

- E-commerce businesses seeking a seamless checkout experience with support for multiple payment methods and currencies

- Subscription-based services, such as software, digital content, or membership sites, that require recurring billing capabilities

- Digital goods and services businesses selling e-books, software downloads, online courses, etc., that need secure payment processing and global reach

- Large enterprises with high transaction volumes that require scalability, advanced fraud protection, and comprehensive reporting and analytics

While 2Checkout may not offer as specialized features as Paddle for certain niche use cases, its flexibility, extensive payment options, and ability to handle enterprise-level demands make it an attractive choice for businesses looking for a reliable and robust payment gateway solution.

Paddle vs 2Checkout: Choosing Your Payment Processor

Choosing the right payment processor boils down to your specific business needs and priorities. Both Paddle and 2Checkout are industry leaders, but they excel in different areas.

Pick Paddle if:

- You’re a well-established business with complex global operations (SaaS companies, gaming studios, digital publishers).

- You require sophisticated features like metered billing, global tax compliance, and detailed customer spending data.

- You operate on a WordPress platform and want seamless integration (Paddle for EDD and Paddle for WooCommerce).

Choose 2Checkout if:

- You’re a business of any size seeking a versatile payment solution with global reach.

- You prioritize a seamless checkout experience with diverse payment methods and currencies.

- You require recurring billing capabilities for subscriptions or memberships.

- You’re a large enterprise with high transaction volumes and need scalability, advanced security, and robust reporting.

Ultimately, the best way to decide is to consider your specific needs, budget, and technical expertise. Both Paddle and 2Checkout offer free trials, allowing you to explore their features and user interface firsthand before committing.