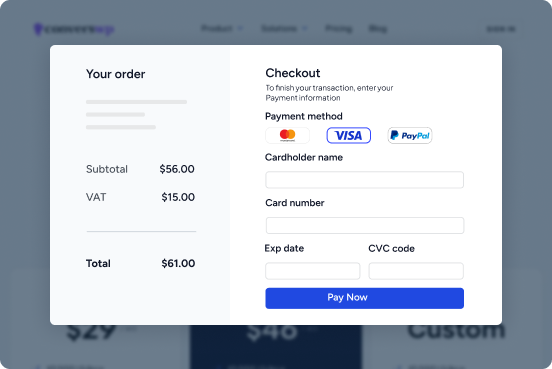

When you open an ecommerce store, it’s crucial that people have a lot of payment options to choose from. In order to accept payments through various services, payment gateways will come in handy.

In this guide, we’re diving deep into the world of payment gateways and how to seamlessly integrate them into your WooCommerce setup. This is to make sure your customers can pay using their credit cards.

Picture this: a user-friendly shopping experience that not only showcases your fantastic products but also allows your customers to pay with their preferred credit cards. The result?

A checkout process smoother than a silk ribbon on a summer breeze.

So, buckle up as we dig deeper. We hope this guide puts you on the path to boosting those sales and delighting your customers.

What is a Payment Gateway?

A payment gateway is like the digital bouncer that stands between your wallet and the online store’s cash register.

It’s like the virtual middleman that handles your payment info securely.

It takes the data you punch in, like credit card details, and makes sure it gets to the store’s bank safe and sound.

Role of Payment Gateways in E-commerce Transactions

Imagine if you had to send your credit card info to every online store you buy from. Yikes, right? Payment gateways save the day by keeping your sensitive info under lock and key.

They encrypt your data, turning it into secret code that only the right parties can decode. This means you can shop around without worrying about your info falling into the wrong hands.

Plus, they’re super speedy. When you click that “Buy Now” button, the payment gateway works its magic, checking if your funds are good to go and if the transaction is legit. It’s like the flash of the e-commerce world, making sure everything happens in a blink.

Security Measures in Payment Processing

Payment gateways throw on a serious armor of security measures. Think firewalls, encryption, and secure protocols. They’re like the digital Fort Knox, making sure no sneaky cyberthieves can swoop in and steal your payment details.

Ever heard of the term PCI DSS? It stands for Payment Card Industry Data Security Standard – a fancy way of saying these gateways follow a strict set of rules to keep your payment info safe.

They’re the guardians that make sure the bad guys can’t just waltz in and take what’s yours.

Selecting the Right Payment Gateway

When it comes to picking the perfect payment gateway for your WooCommerce store, you’ve got some important decisions to make. Let’s break it down.

- Compatibility: First up, make sure the payment gateway plays nice with WooCommerce. You want them to be best buddies, so your checkout process stays smooth.

- Fees: Ah, fees. Nobody likes surprises, right? Check what the payment gateway charges for each transaction. Sometimes, there’s a setup fee too.

- Accepted Payment Methods: Different customers, different preferences. Look for a gateway that supports a variety of payment options like credit cards, digital wallets, and maybe even cryptocurrencies.

- Security: Lock it down! Security is crucial. Your customers need to trust that their payment info is safe. So, opt for a gateway with solid encryption and fraud prevention.

- User Experience: Keep it easy-peasy. The gateway should offer a user-friendly experience that doesn’t confuse your customers. A few clicks, and they’re done!

- Integration: Time is money. Choose a gateway that’s simple to integrate into your WooCommerce setup. You don’t want a headache, do you?

- Mobile-Friendly: Everyone’s on their phones these days. So, make sure the gateway works seamlessly on mobile devices. No one likes a wonky mobile checkout.

- Customer Support: We all need a helping hand sometimes. Go for a gateway with good customer support. If things go south, you’ll be glad you did.

- Scalability: Think ahead. As your store grows, your gateway should be ready to handle increased traffic and transactions without breaking a sweat.

- Reviews and Reputation: A little detective work won’t hurt. Check out reviews and the gateway’s reputation. You want a reliable partner for your online business.

Consider these factors carefully, and you’ll be well on your way to a checkout experience that’s as smooth as butter.

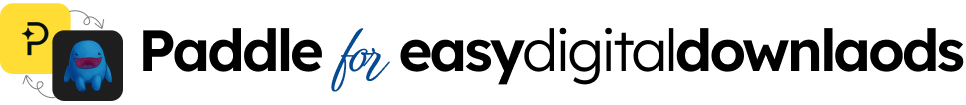

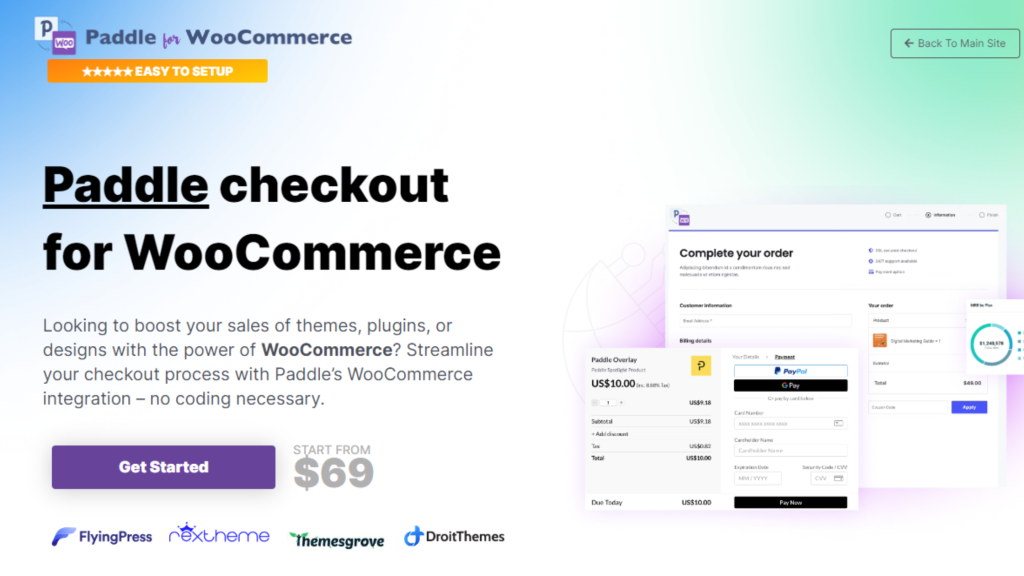

Introduction to Paddle checkout for WooCommerce as a Payment Gateway

Paddle Checkout for WooCommerce is a powerful tool that allows online businesses to seamlessly integrate Paddle’s payment processing capabilities into their WooCommerce stores.

With Paddle Checkout for WooCommerce, you can provide a smooth and secure checkout experience for your customers, while also benefiting from Paddle’s advanced features.

By integrating Paddle Checkout into your WooCommerce store, you can offer a wide range of payment methods to your customers, including credit cards, PayPal, and Apple Pay.

This flexibility ensures that your customers can choose the payment option that suits them best, increasing the chances of completing a purchase.

Integrating Paddle Payment Gateway

Now let’s walk you through the process of integrating the Paddle payment gateway with WooCommerce. By following these steps, you’ll be able to seamlessly accept payments through Paddle on your WooCommerce-powered online store.

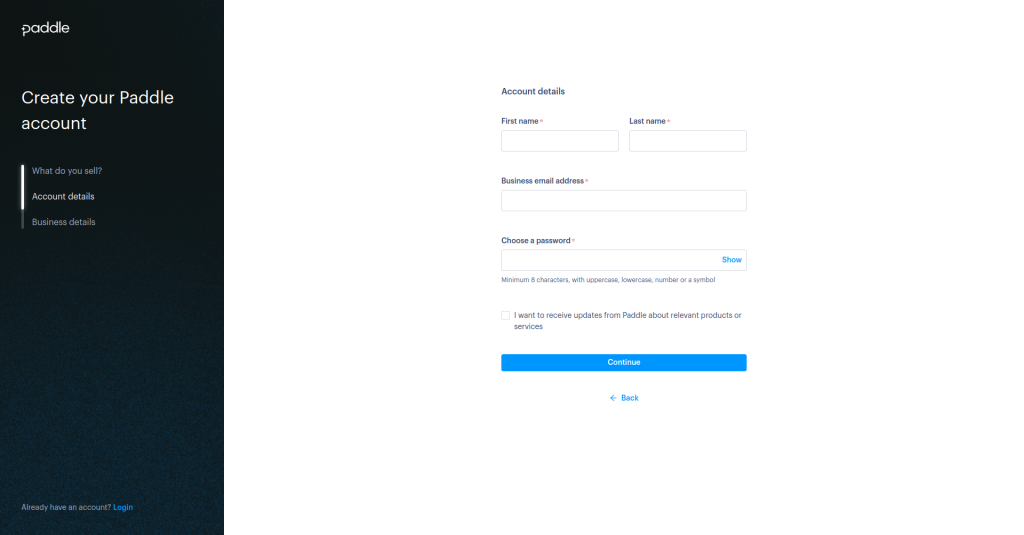

Creating a Paddle Account:

To get started, head over to the Paddle website and create an account. Fill in the required information and complete the registration process.

Once you have your Paddle account set up, you’re ready to move on to the next step.

Installing and Activating Paddle for WooCommerce Plugin:

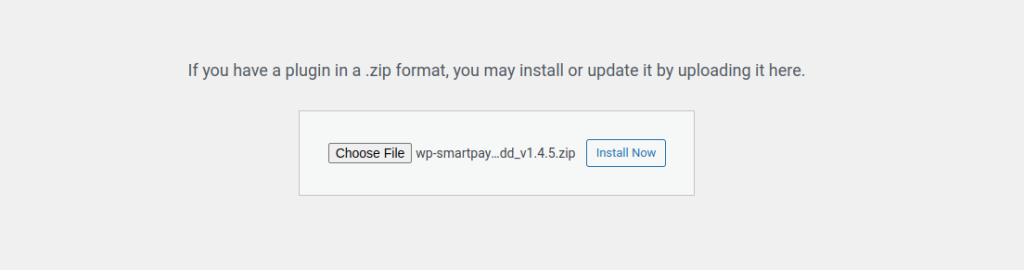

In your WordPress dashboard, navigate to the “Plugins” section and click on “Add New.” Upload the “Paddle for WooCommerce” plugin and click on “Install Now.” Remember, you need to download it from here before starting the installation process.

After the installation is complete, activate the plugin.

Configuring Paddle Settings:

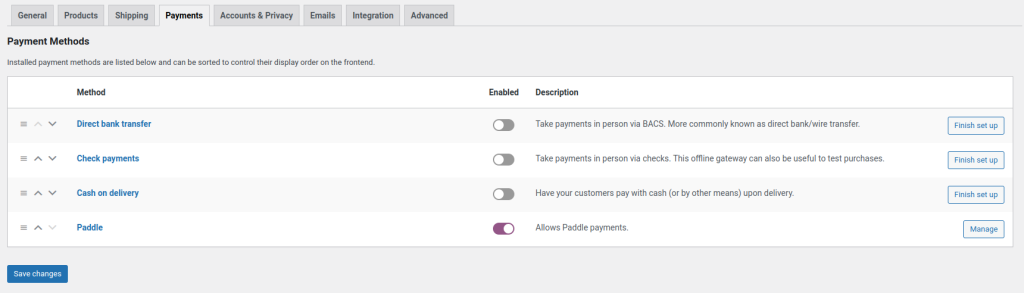

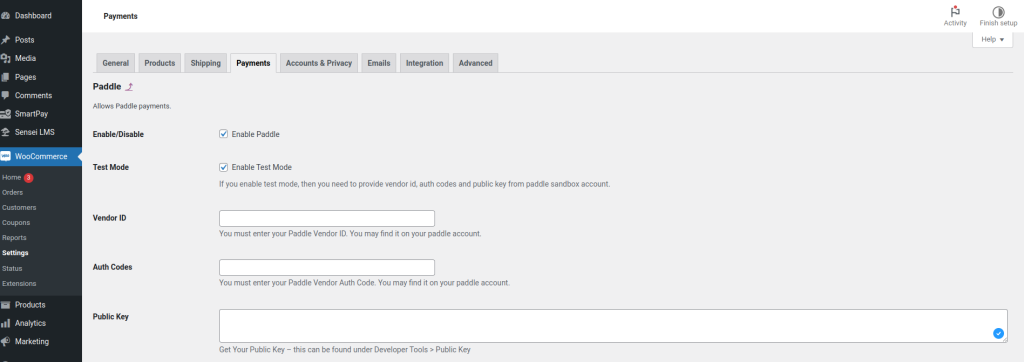

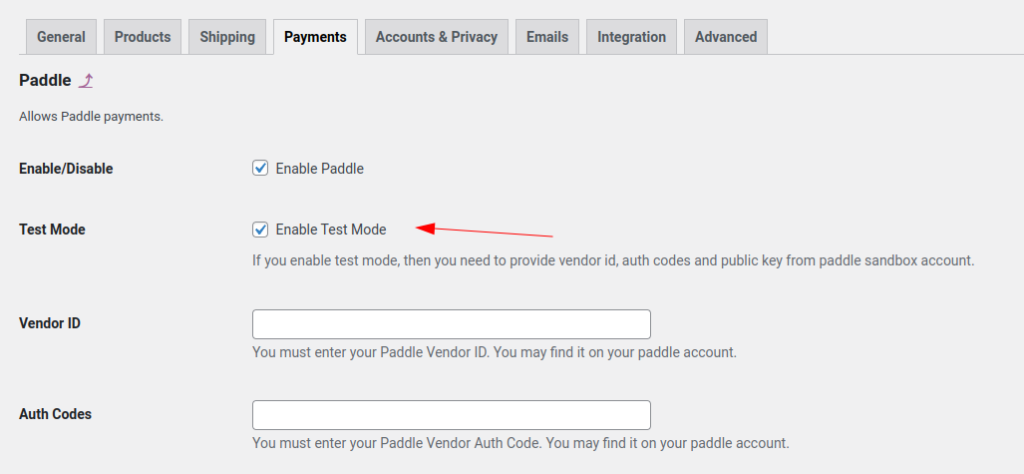

Now, go to the WooCommerce settings page and click on the “Payments” tab. You should see the Paddle payment gateway listed there. Click on it to access the settings.

Adding Paddle API Credentials:

To connect your Paddle account with WooCommerce, you’ll need to enter your Paddle API credentials. These can be found in your Paddle account settings. Copy and paste the API credentials into the corresponding fields in the WooCommerce settings.

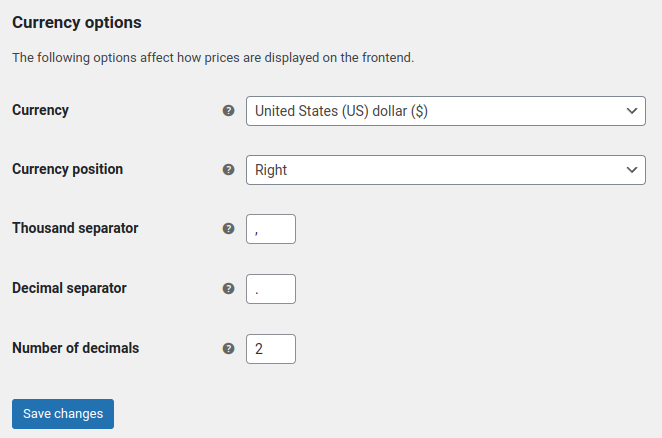

Setting Up Accepted Currencies:

In the Paddle settings, you can specify the currencies you want to accept. Choose the currencies that align with your business requirements and save the changes.

Enabling Test Mode for Testing:

Before going live, it’s a good idea to test the integration. In the Paddle settings, enable the test mode. This allows you to simulate transactions without processing real payments. It’s crucial to ensure everything is working smoothly before accepting real payments.

This ensures that when a customer purchases a product on your WooCommerce store, the payment is processed through Paddle.

By following these steps, you can make payments seamlessly on your WooCommerce store.

Remember to thoroughly test the integration and ensure everything is working as expected before going live.

This will allow you to simulate transactions without actually processing any real payments. It’s a great way to test your integration without incurring any charges.

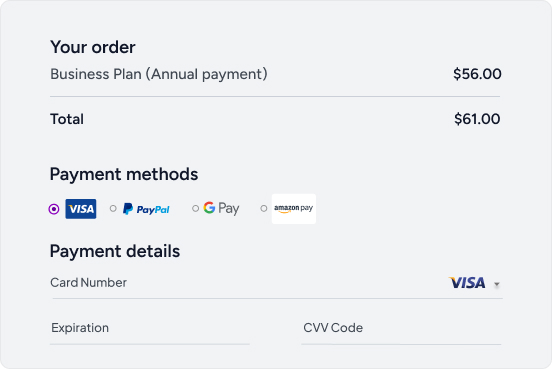

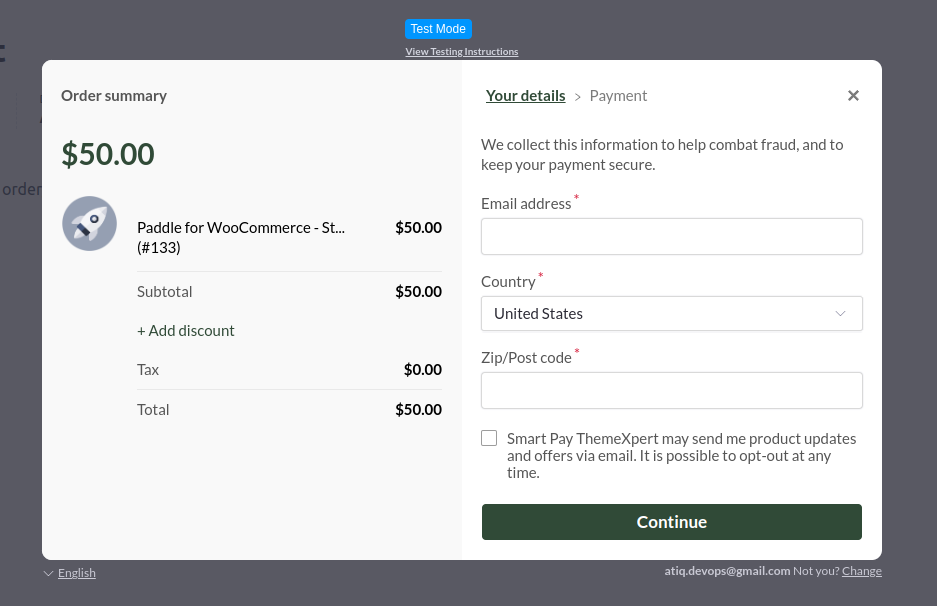

Making Test Transactions

After enabling test mode, you can move on to making test transactions. This step is crucial to ensure that your integration with Paddle is working correctly.

To make a test transaction, you’ll need to use the provided test card details. These test card details are specifically designed for testing purposes and won’t result in any actual charges.

You can find these details in the Paddle documentation or developer resources.

Once you have the test card details, you can initiate a test transaction within your application or website. This will simulate a transaction as if it were a real payment, allowing you to verify that everything is functioning as expected.

You can check if the transaction is processed correctly, if the payment status is updated, and if any necessary notifications or callbacks are triggered.

Fine-Tuning the Payment Experience

When it comes to providing a seamless payment experience for your customers, customization is key. In this section, we will explore some important aspects of fine-tuning the payment process to meet your specific needs.

Customizing Checkout Page

The checkout page is where your customers make the final decision to complete their purchase. By customizing this page, you can create a branded and user-friendly experience that aligns with your business’s identity.

Consider adding your logo, choosing a color scheme that matches your website, and providing clear instructions to guide customers through the payment process.

Handling Taxes and Shipping

Taxes and shipping are crucial factors to consider when it comes to the payment experience. Ensure that your customers have a clear understanding of any additional costs associated with their purchase.

You can provide an estimated shipping cost calculator or clearly state the shipping charges upfront. Similarly, make sure to calculate and display taxes accurately, taking into account any regional or international tax regulations.

Configuring Tax Settings

Configuring tax settings is an essential step in fine-tuning the payment experience. Depending on your business’s location and the regions you serve, you may need to apply different tax rates.

It’s important to research and understand the tax laws and regulations that apply to your business. This way, you can ensure that your customers are charged the appropriate taxes, creating a transparent and trustworthy payment process.

Managing Shipping Options

Offering flexible shipping options can greatly enhance the payment experience for your customers. Consider providing multiple shipping methods, such as standard, expedited, or even free shipping for certain orders.

Additionally, allow customers to track their shipments and provide estimated delivery dates. By managing shipping options effectively, you can provide a convenient and reliable experience that encourages repeat business.

Ensuring Security and Compliance

When it comes to running an online business with WooCommerce, ensuring the security and compliance of customer data is of utmost importance. Let’s discuss three key topics that can help you safeguard your customers’ information: securing customer payment data, PCI DSS compliance, and GDPR considerations.

Securing Customer Payment Data

One of the most critical aspects of maintaining security is protecting customer payment data. This includes credit card numbers, bank account details, and any other sensitive information related to financial transactions.

To ensure the safety of this data, it is essential to implement robust security measures. This can involve using encryption technologies, secure payment gateways, and regularly updating your systems to patch any vulnerabilities.

By doing so, you can minimize the risk of data breaches and unauthorized access to customer payment information.

PCI DSS Compliance

If your business accepts credit card payments, it is crucial to comply with the Payment Card Industry Data Security Standard (PCI DSS). This set of security standards is designed to protect cardholder data and maintain a secure payment environment.

To achieve PCI DSS compliance, you need to follow specific guidelines, such as maintaining a secure network, regularly monitoring and testing your systems, and implementing strong access control measures.

GDPR Considerations

The General Data Protection Regulation (GDPR) is a regulation that governs the protection of personal data for individuals within the European Union (EU).

Even if your business is not based in the EU, if you process the personal data of EU citizens, you must comply with GDPR requirements.

This means obtaining explicit consent from individuals to collect and process their data, providing them with the right to access and delete their information, and implementing appropriate security measures to protect their data.

This way, you can ensure that your business operates in a manner that respects individuals’ privacy rights.

These processes help you protect your customers’ information and maintain their trust. Remember, investing in robust security measures and staying up to date with evolving regulations is an ongoing process that requires continuous attention and effort.

Exploring Additional Payment Gateway Options

Some popular payment gateways that work with WooCommerce, other than Paddle, include:

- Stripe: Stripe is the most popular payment gateway for accepting credit card payments on your website. It has built-in support in WooCommerce and is trusted by millions of businesses worldwide.

- PayPal: PayPal is one of the biggest names in the market when it comes to payment gateways. It is widely used and can be integrated with WooCommerce through various extensions.

- Square: Square is another popular payment gateway that offers a range of services, including online payments. It can be integrated with WooCommerce to accept payments securely.

- Authorize.net: Authorize.net is a widely used payment gateway that supports credit card payments. It has an extension available for WooCommerce integration.

- Amazon Pay: Amazon Pay allows customers to use their Amazon accounts to make payments on your WooCommerce store. It provides a seamless checkout experience.

- Apple Pay: Apple Pay enables customers to make payments using their Apple devices. It offers a convenient and secure payment method for WooCommerce stores.

- Alipay: Alipay is a popular payment gateway in China. It allows customers to make payments using their Alipay accounts and can be integrated with WooCommerce.

These are just a few examples of popular payment gateways that are compatible with WooCommerce. There are many more options available, depending on your specific needs and location.

Wrapping up!

We hope now you’re all prepped to incorporate the best payment option for your business. We believe with the help of this guide, you’re going to breeze through the setup process like a pro, and ensure your customers’ hard-earned cash is as secure as a fortress.

Remember, when folks go shopping online, the whole buying experience can swing their mood from super happy to a tad down. By plugging in a payment system that seamlessly fits, you’re not just dealing with payments – you’re building trust, simplifying things, and embarking on a journey towards online success.

Happy selling!