SaaS businesses, assemble! It’s time to settle the score in the ultimate payment gateway showdown: Paddle vs FastSpring. Both these premium payment gateways promise smooth checkouts, global reach, and subscription diversity, but who reigns supreme?

We’ll be putting features under the magnifying glass, dissecting their pricing plans, and revealing their hidden strengths and weaknesses. By the end, you’ll have the intel you need to pick a champion for your business.

So, buckle up and grab your scuba gear – we’re going in deep!

What are Paddle and FastSpring?

Paddle

Paddle is a robust payment platform that focuses exclusively on providing an end-to-end payments infrastructure tailored for SaaS, software subscription, and digital goods merchants. It excels at handling global sales, including subscriptions, one-time transactions, and complex tax compliance like VAT. Whether you’re a SaaS provider, software platform, or digital product vendor, Paddle offers powerful features and seamless scalability to support your growth.

Key Features

- 5% + 0.50¢ per sale flat rate pricing

- Built-in sales tax compliance for Europe, US, Canada, and Australia

- Fully customizable localized checkout options across 200+ countries and multiple currencies

- Automated VAT collection, filing and verification capabilities

- Focused subscription monetization tools like metered billing and instant license generation

- One-click instant payouts directly to all major banks globally

- Streamlined affiliate program and partner payout management

- Painless transparent platform pricing with sliding fee scale models

Of course, their comprehensive security standards make the list too – PCI DSS Level 1 compliance, bank-level encryption, extensive fraud protection and high service uptime guarantees.

Best Use Cases

- SaaS Companies: Manage global subscriptions and tax complexities effortlessly.

- Software Platforms: Offer secure and convenient purchasing options for digital products.

- Digital Product Vendors: Streamline sales processes and focus on creating amazing products.

FastSpring

FastSpring is a flexible eCommerce platform built specifically to sell digital products and services. It provides robust subscription management and billing tools to support complex recurring revenue models. Whether you offer SaaS, PaaS, downloadable software or any digital product, FastSpring simplifies global commerce.

Key Features

- Volume-tiered pricing starts at 4.9% + $0.49 per transaction

- Automated VAT/GST calculations and filing for 90+ countries

- Localized checkout pages in over 25 languages and 130 currencies

- Flexible billing options including subscriptions, usage-based pricing, installments

- Instant global payouts, daily reconciliations and consolidated reporting

- PCI DSS Level 1 and SOC 2 compliance for enterprise-grade security

FastSpring also provides comprehensive solutions for taxes, fraud protection, affiliate and partner programs and more.

Best Use Cases

- SaaS platforms: Optimize pricing models, subscriptions and reporting

- Digital publishers: Simplify global eCommerce and financial operations

- Software vendors: Focus on product while FastSpring handles commerce

Paddle Vs FastSpring: Features and Functionality

Both Paddle and FastSpring are heavyweights in the online payment processing arena, catering specifically to software businesses, digital goods sellers, eCommerce and SaaS companies. They boast comprehensive feature sets to streamline global sales, manage subscriptions, and boost revenue. But how do they compare head-to-head? Let’s take a closer look at their key functionalities:

| Features | Paddle | FastSpring |

|---|---|---|

| Target Audience | Ambitious online businesses, SaaS providers, software platforms, digital product vendors, WordPress-based eCommerce and digital download businesses (Paddle for EDD and Paddle for WooCommerce) | SaaS, PaaS, digital services, downloadable software |

| Global Reach | 200+ currencies, localized checkout experiences | 130+ currencies, 25+ localized checkout pages |

| Subscriptions | Powerful management tools, flexible pricing plans, churn reduction strategies | Advanced subscription management, automated renewals, cancellation handling |

| Tax Compliance | Handles VAT and other regional taxes | Automatic VAT collection, filing & verification, global tax compliance tools |

| Security | Robust PCI-DSS compliance, advanced fraud prevention, data encryption | PCI-DSS Level 1 compliant, sophisticated fraud detection, bank-level encryption |

| Scalability | Handles high transaction volumes, scales with your business | Built for scalability, accommodates diverse sales volumes |

| Ease of Use | User-friendly interface, but requires some technical knowledge | Intuitive platform, ideal for technical and non-technical users |

| Built-in Marketing Tools | Limited integrations with marketing platforms | Affiliate program management, built-in email marketing tools |

| Mobile-First | Mobile-optimized checkout | Fully mobile-optimized checkout experience |

| Pricing | Transaction fees + potential volume discounts | Transaction fees, tiered pricing model with additional features at higher tiers |

| Hidden Fees | None | Potential chargeback fees |

| Integrations | More integrations with eCommerce platforms and tools | Solid integrations with CRMs, marketing platforms, and other business tools |

| Reporting and Analytics | Robust reporting and analytics capabilities powered by ProfitWell Metrics | Detailed reports, data visualizations, insights for informed decision-making |

| Customer Support | Extensive customer support options | Email and chat support, paid plans for priority support |

Note: If you’re using Easy Digital Downloads or WooCommerce, consider Paddle for EDD and Paddle for WooCommerce. They offer native integrations and optimized features for those platforms, streamlining setup and maximizing your WordPress experience.

Paddle for EDD

- Targets users of the Easy Digital Downloads (EDD) plugin, a popular platform for selling digital products on WordPress.

- Seamlessly integrates Paddle’s powerful capabilities like global payments, subscriptions, tax compliance, and advanced fraud protection within the EDD interface.

- Provides additional features like automatic license generation, discount management, and one-click payouts, all geared towards simplifying and scaling digital product sales through EDD.

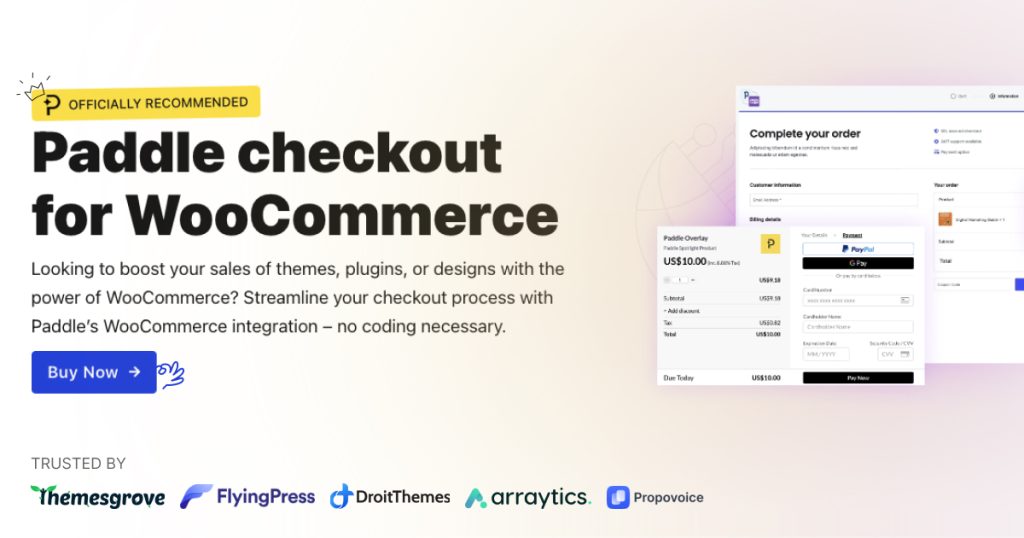

Paddle for WooCommerce

- Caters to users of the WooCommerce plugin, a widely used eCommerce platform for WordPress.

- Connects WooCommerce websites with Paddle, enabling secure and smooth processing of one-time and recurring payments for physical and digital goods.

- Offers features like convenient checkout experiences, international tax handling, and robust subscription management tools specifically designed for WooCommerce environments.

Essentially, both Paddle for EDD and Paddle for WooCommerce leverage the benefits of the Paddle payment gateway but make them readily accessible and enhance their functionality within the familiar interfaces of EDD and WooCommerce, respectively. This makes them ideal choices for WordPress users already comfortable with these plugins and wanting powerful payment solutions without leaving their preferred platform.

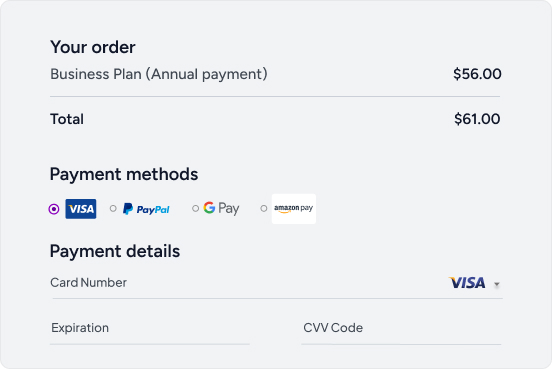

Supported Payment Methods

Paddle: Think global citizen here. With over 200 currencies, popular e-wallets like Apple Pay and Alipay, and adaptable local payment methods like SEPA Direct Debit, Paddle embraces your customers’ preferred payment options anywhere in the world. This inclusivity fosters trust and smoothens cross-border transactions, especially in emerging markets.

FastSpring: While offering a respectable range of currencies and cards, their reach in alternative and local payment methods pales in comparison to Paddle. This might limit your accessibility to specific regions and customer segments, potentially hindering global expansion plans.

Global Reach

Paddle: Picture borderless commerce at its finest. Paddle enables sales in 200+ countries, complete with localized checkout experiences tailored to language, currency, and cultural preferences. Paddle simplifies international expansion, new product launches and more. This creates a seamless and familiar experience for customers worldwide, boosting conversion rates and brand loyalty. They also provide more strategic support compared to FastSpring.

FastSpring: While not quite as expansive, they still open doors to international markets. Basic localization options cater to those seeking moderate expansion beyond their home turf. However, for businesses with truly global ambitions, Paddle’s comprehensive reach might be the missing piece.

Currency Conversion

Paddle: Say goodbye to manual calculations and potential pricing errors. Paddle handles automatic currency conversion at competitive rates, ensuring a hassle-free experience for both you and your customers. This removes a technical hurdle and fosters trust in your global pricing strategy.

FastSpring: While they offer currency conversion functionality, it requires manual setup or integration with third-party providers. This adds an extra step to your workflow and introduces potential management complexities, especially for businesses dealing with frequent international transactions.

Fraud Prevention

Paddle: Security is their middle name. Paddle utilizes advanced fraud detection tools and real-time risk analysis to proactively identify and block suspicious activity. This protects both your business and your

customers from financial losses, giving you peace of mind to focus on growth.

FastSpring: They offer basic fraud prevention tools, providing a layer of protection. However, for businesses concerned about high-risk transactions or requiring more comprehensive security, their optional upgrade for advanced protection might be necessary, adding an extra cost layer.

Chargeback Management

Paddle: Don’t let disputed transactions slow you down. Paddle assists in chargeback resolution, taking the complexity out of the process. Additionally, they attempt to retry declined transactions automatically, potentially salvaging lost sales. This proactive approach minimizes disruptions and maximizes revenue potential.

FastSpring: While they provide tools for handling chargebacks, the onus falls entirely on the user. This requires manual dispute management, which can be time-consuming and resource-intensive, especially for businesses facing frequent chargebacks.

Reporting and Analytics

Paddle: Dive deep into data-driven insights with rich analytics powered by ProfitWell Metrics. This tailor-made solution for subscription businesses allows you to benchmark key SaaS metrics against industry data, utilize predictive modeling to identify at-risk accounts, and access API pipelines for data-driven decision-making. This eliminates the need for separate analytics tools and empowers you to optimize your pricing, churn reduction strategies, and expansion plans.

FastSpring: They offer basic merchant analytics, covering key data points like revenue, customer lifetime value, and transaction trends. While sufficient for basic eCommerce needs, this falls short for complex SaaS analytics. The lack of industry benchmarks, advanced churn signals, and API extensibility limits your ability to make data-driven strategic decisions.

Integrations

Paddle: Streamline your workflow with a vast library of integrations covering popular eCommerce platforms, CRMs, marketing tools, and more. This seamless ecosystem allows for automated tasks and data exchange, boosting efficiency and productivity. Additionally, dedicated solutions like Paddle for EDD and Paddle for WooCommerce cater specifically to WordPress users.

FastSpring: While offering essential integrations for email marketing and analytics, their selection pales in comparison to Paddle. This might be limiting for businesses relying on complex integrations with diverse software tools.

Distinct Features of Paddle and FastSpring

Paddle

Flexible Monetization Tools: Paddle makes it easy for SaaS companies to experiment with pricing models and optimize monetization strategies over time. Its metered billing and usage-based pricing features support innovative models like trials, free plans, credits, and more. This flexibility allows businesses to fine-tune their offerings to maximize revenue.

Comprehensive Tax Management: For companies selling software globally, tax compliance is a major headache. Paddle provides complete VAT, GST and sales tax solutions out-of-the-box for Europe, North America, Australia and beyond. This saves teams the pain of managing different jurisdictional rules and filings.

Instant Global Payouts: Paddle offers one-click payouts directly to bank accounts across the world, with daily transaction reconciliation. This level of speed and transparency for global payments is extremely rare in the payments industry. Sellers can access their earnings instantly no matter where they are located.

FastSpring

Flexible Billing and Pricing: While not as flexible as Paddle, FastSpring supports a wide range of billing models to match any product offering or monetization strategy. This includes one-time payments, recurring subscriptions, usage-based pricing metered plans, installments, and more.

Automated Tax Compliance: Companies selling digital products globally take on huge tax compliance burdens. FastSpring simplifies this by automatically calculating localized VAT, GST, PST and more at checkout in over 90 countries. It also handles related filings and verification.

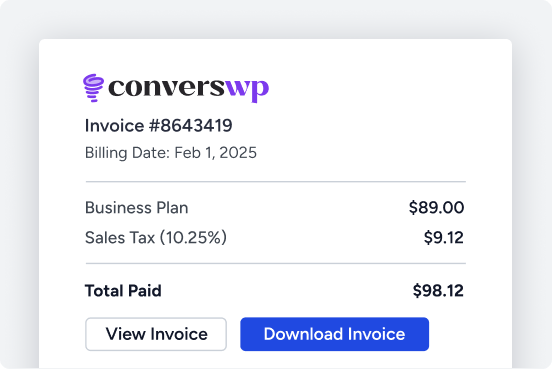

Frictionless Accounting: FastSpring makes financial operations seamless by providing daily reconciled payment reporting that integrates with QuickBooks and other accounting systems. This level of transparency, speed and accuracy helps businesses stay lean.

By calling out platform strengths aligned to customer needs – advanced revenue models, simplified taxes, faster payouts etc – you can provide clarity to help buyers pick the right solution.

Pricing and Fees

When choosing a payment services provider, one of the most crucial considerations for any business is costs. Between payment processing rates, platform fees, and additional hidden costs, expenses can quickly pile up. In this section, we examine and compare the pricing models of Paddle and FastSpring.

Paddle Pricing

Paddle offers an all-inclusive, transparent pricing model covering payments, subscription billing, tax compliance, fraud protection, and more under one platform. There are no hidden fees or additional costs.

Their pay-as-you-go pricing starts at 5% + 0.50¢ per transaction, delivering essentials like global payments, built-in tax compliance, chargeback protection, and fraud screening.

Paddle provides customized pricing for rapidly scaling or large enterprises to unlock additional premium capabilities like migration services, implementation support, and dedicated success management.

It’s important to note that there are services, Paddle for EDD and Paddle for WooCommerce, that offer customized pricing plans suited for the specific needs of WordPress sites, taking into account transaction volume, subscriptions, and other factors. These services both start at $89/year. For more detailed information visit this link.

FastSpring Pricing

FastSpring leverages a volume-based tiered pricing structure. Rates start at 4.9% + $0.49 per transaction covering payment acceptance, tax management, compliance and more.

As monthly sales volume increases, rates steadily decline. FastSpring’s enterprise plans unlock the lowest possible rates, high ticket transaction optimizations and dedicated support.

FastSpring also provides customized solutions for complex seller needs around licensing, channel sales, usage metering and more. These specialized plans carry tailored pricing.

The core value proposition from both platforms is transparent, all-inclusive pricing with no hidden fees. As businesses scale, expanded discounts and enterprise options provide further incentives to grow.

Ultimately however, Paddle offers all core payments infrastructure tools in one platform under simplified pricing whereas with FastSpring you pay extra fees for add-ons tools and support. Which can be annoying to say the least.

Ease of Use and Support

When evaluating a billing and payment platform, ensuring a positive user experience through intuitive interfaces and helpful resources is key. Both Paddle and FastSpring emphasize simplifying processes to reduce friction for merchants across global tax compliance, subscription management, payouts and beyond.

For Paddle, easy-to-configure billing models, actionable customer insights, tailored gaming monetization features, and localized checkout experiences are top strengths that underpin their commitment to user-focused design principles. Hands-on support and 95%+ customer satisfaction gives Paddle users peace of mind during launch and expansion stages. FastSpring offers more limited assistance.

Testimonials from CEOs attribute considerable operational efficiencies and cost savings to Paddle’s ability to minimize billing administration overheads. Access to ongoing revenue metric benchmarking against wider industry subscription data also provides data-driven assistance.

FastSpring enables users to get started and sell quickly thanks to simple initial configuration. At the same time, their platform offers advanced controls and customization capabilities more tailored to technical users.

Sellers benefit from consolidated daily payment reporting across transactions, refunds, affiliates and taxes. This drives transparency and makes reconciliation efficient. Users also appreciate 24/5 live chat, phone and email support resolving inquiries swiftly.

Both platforms aim to maximize seller productivity by minimizing repetitive billing and financial admin. Paddle’s subscriber analytics and FastSpring’s transparent reporting further empower merchants via valuable business insights.

Security and Compliance

With payment platforms processing valuable customer data, having rigorous security protocols and compliance with privacy regulations is non-negotiable. We examine how Paddle and FastSpring stack up on key parameters of trust and transparency for customers.

Paddle offers best-in-class security reinforced through adhering to SOC 2, GDPR standards, undergoing regular pentests/audits, and being PCI DSS Level 1 certified – the most stringent level. Their security portal offers in-depth documentation around policies, procedures, recovery metrics, access control, and development practices.

With AWS cloud hosting, role-based access controls, MFA authentication, and advanced threat monitoring via SIEM systems, they check all the boxes for enterprise-grade security. A dedicated security team and proactive vulnerability disclosure program further underpin their mature posture.

FastSpring is a leader in security with PCI DSS Level 1 and SOC 2 Type II attestations, providing enterprise-grade assurance. Backed by Azure infrastructure, they leverage two-factor authentication, TLS 1.2 encryption, strict access controls and more.

Annual risk assessments and penetration testing supplemented by third-party vulnerability scanning hardens FastSpring against threats. Extensive logging and monitoring maintains optimal visibility across payments, data and systems.

Both platforms exceeding baseline compliance requirements indicates a strong, shared commitment to security and transparency. While smaller providers may offer adequate protections too, larger vendors with dedicated security teams generally inspire more confidence through greater resourcing and validation.

Use Cases and Recommendations

With a detailed analysis of core capabilities, security, pricing, and ease of use behind us – we wrap up with recommendations on ideal customer profiles who stand to benefit the most from Paddle and FastSpring’s respective offerings.

Businesses Who Are Best Suited for Paddle:

Given its robust feature set and premium pricing, Paddle shines best for well-established businesses with complex global operations including:

- Mid-market to enterprise SaaS companies earning over $10M+ in revenue

- Gaming studios with 50,000+ users and multi-SKU monetization

- Digital publishers generating high 6-7 figure subscription income

- WordPress-based eCommerce and digital download businesses. Paddle for EDD and Paddle for WooCommerce are tailor-made for these platforms, offering powerful features and seamless integration to help your WordPress site thrive

Specifically, the ability to customize sophisticated subscription billing constructs, executive sales tax calculations across 200+ countries, and tap detailed cross-border consumer spending data make Paddle worthwhile for expanding companies.

Those needing niche accommodations like metered pricing models for API usage, certificate generation for software licenses, or risk management around fluctuating cross-border tax jurisdictions will find that they have unmatched capabilities with Paddle.

Great Fits for FastSpring’s Offerings:

In contrast, FastSpring hits the mark for entrepreneurs, developers and creators such as:

- Bootstrapped SaaS startups earning up to $1M in revenue

- Independent software vendors with 10,000+ customers

- Digital publishers selling one-time access to premium resources

- Platform businesses with usage-based pricing models

For these users, FastSpring simplifies global commerce complexities through automated tax compliance, consolidated reporting, and predictable revenue collection and payouts – freeing up resources better spent enhancing core products.

Evaluating business lifecycle stages, revenue patterns, global ambitions and specific functional needs helps direct companies to the payment platform that best supports their priorities and constraints at a suitable price point.

Summing up….

In this article, we analyzed payment platforms Paddle and FastSpring across pricing, features, security, use cases and more.

The core difference is this: Paddle offers unmatched flexibility for sophisticated SaaS firms to optimize complex global monetization with pricing starting at 5% + $0.50 per transaction.

FastSpring simplifies hassle-free global commerce for early-stage startups and bootstrapped founders, with rates beginning at 4.9% + $0.49 per transaction.

We recommend mapping core needs around recurring billing, global payments, tax compliance, ease of use and scaling requirements against provider capabilities ― choosing the platform that aligns both to current scenarios and future ambitions.

Enterprises managing intricate licensing models, usage pricing and aggressive expansion find Paddle’s customization worthwhile despite steeper costs. Meanwhile, those just starting out unlock better value from FastSpring’s pared-down feature set.

Assess tradeoffs, outline must-haves, and take a tiered view that fits payment solutions to your roadmap at each business lifecycle stage for optimal value.

Takeaway from this? Simplify launch with FastSpring or deepen monetization through Paddle based on your priorities.