Have you ever found yourself in a situation where you needed to accept payments, but the process seemed more complicated than it should be?

Maybe you’re a small business owner, a freelancer, or someone who sells products or services online. Whatever your scenario, having a reliable and user-friendly payment processing solution can make all the difference.

Enter Paddle and Square, two giants in the world of payment processing. Both platforms have made it their mission to simplify the way we handle transactions, but they go about it in slightly different ways.

In this article, we’ll dive deep into the features, pricing, and overall user experience of each service, helping you determine which one might be the better fit for your needs.

Whether you’re a tech-savvy entrepreneur or someone who prefers to keep things straightforward, we’ll break down the nitty-gritty details in a way that’s easy to understand.

So grab a cup of your favorite beverage, and let’s explore the pros and cons of Paddle and Square together. Who knows? By the end of this read, you might just find the payment processing partner you’ve been searching for.

What are Paddle and Square?

Paddle

Paddle is a robust payment platform that focuses exclusively on providing an end-to-end payments infrastructure tailored for SaaS, software subscription, and digital goods merchants. It excels at handling global sales, including subscriptions, one-time transactions, and complex tax compliance like VAT. Whether you’re a SaaS provider, software platform, or digital product vendor, Paddle offers powerful features and seamless scalability to support your growth.

Key Features

- 5% + 0.50¢ per sale flat rate pricing

- Built-in sales tax compliance for Europe, US, Canada, and Australia

- Localized checkout options across 200+ countries and multiple currencies

- Automated VAT collection, filing and verification capabilities

- Focused subscription monetization tools like metered billing and instant license generation

- One-click instant payouts directly to all major banks globally

- Streamlined affiliate program and partner payout management

- Painless transparent platform pricing with sliding fee scale models

Of course, their comprehensive security standards make the list too – PCI DSS Level 1 compliance, bank-level encryption, extensive fraud protection and high service uptime guarantee

Best Use Cases

- SaaS Companies: Manage global subscriptions and tax complexities effortlessly.

- Software Platforms: Offer secure and convenient purchasing options for digital products.

- Digital Product Vendors: Streamline sales processes and focus on creating amazing products.

Square

Square is a popular payment processing solution that has revolutionized the way small businesses and individuals accept payments. Founded in 2009, Square has grown into a comprehensive ecosystem of hardware and software products designed to streamline the payment experience for merchants and customers alike.

Key Features

- Basic multi-tiered pricing with services and products across a wealth of industries and business types.

- Easy payment acceptance with a card reader that connects to a smartphone/tablet app

- Robust Point of Sale (POS) system with inventory management, employee management, reporting, and accounting integrations

- Online store for e-commerce businesses to sell products/services online

- Virtual Terminal for accepting remote payments over the phone or online

- Square Appointments for service-based businesses to manage schedules and online bookings

Square prioritizes end-to-end payment security, including PCI compliance, expert dispute assistance, robust account protection with 2-factor authentication, proactive fraud monitoring using machine learning, and secure hardware/software design and encryption protocols.

Best Use Cases

- Retail: Retail stores seeking a comprehensive POS system and payment processing solution.

- Food & Beverage: Food and beverage businesses needing tableside ordering, menu management, and kitchen printing features.

- Service-Based: Service-based businesses like salons, spas, and home services requiring appointment scheduling and online bookings.

- E-commerce: Online businesses looking to create a professional e-commerce storefront.

- Mobile: Mobile businesses operating on-the-go and needing portable payment processing capabilities.

Paddle Vs Square: Features and Functionality

Both Paddle and Square are massive services with a plethora of features that require thorough analysis, but before doing a deep dive and looking into every single nook and cranny of these services that are geared for SaaS or eCommerce businesses lets see how they stack up on the surface.

| Features | Paddle | Square |

|---|---|---|

| Target Audience | Ambitious online businesses, SaaS providers, software platforms, digital product vendors, WordPress-based eCommerce and digital download businesses (Paddle for EDD and Paddle for WooCommerce) | Small businesses, retailers, restaurants, service providers, mobile businesses |

| Global Reach | 200+ currencies, localized checkout experiences | Multiple currencies supported, international capabilities may vary |

| Subscriptions | Powerful management tools, flexible pricing plans, churn reduction strategies | Limited subscription management tools |

| Tax Compliance | Handles VAT and other regional taxes | Handles basic sales tax |

| Security | Robust PCI-DSS compliance, advanced fraud prevention, data encryption | End-to-end encrypted payments, PCI compliance, fraud monitoring |

| Scalability | Handles high transaction volumes, scales with your business | Scales to support businesses of all sizes |

| Ease of Use | User-friendly interface, but requires some technical knowledge | Easy to use, no coding required |

| Built-in Marketing Tools | Limited integrations with marketing platforms | Email marketing, text marketing, loyalty program, gift cards |

| Mobile-First | Mobile-optimized checkout | Mobile payment processing via smartphone/tablet |

| Pricing | Transaction fees + potential volume discounts | Transaction fees + potential volume discounts |

| Hidden Fees | None | None |

| Integrations | More integrations with eCommerce platforms and tools | Strong focus on point-of-sale integration, fewer eCommerce platform integrations |

| Reporting and Analytics | Robust reporting and analytics capabilities powered by ProfitWell Metrics | Advanced reporting and analytics tools available |

| Customer Support | 24/7 phone, email, and chat support | 24/7 phone, email, and chat support |

Note: If you’re using Easy Digital Downloads or WooCommerce, consider Paddle for EDD and Paddle for WooCommerce. They offer native integrations and optimized features for those platforms, streamlining setup and maximizing your WordPress experience.

Paddle for EDD

Paddle for EDD:

- Targets users of the Easy Digital Downloads (EDD) plugin, a popular platform for selling digital products on WordPress.

- Seamlessly integrates Paddle’s powerful capabilities like global payments, subscriptions, tax compliance, and advanced fraud protection within the EDD interface.

- Provides additional features like automatic license generation, discount management, and one-click payouts, all geared towards simplifying and scaling digital product sales through EDD.

Paddle for WooCommerce

- Caters to users of the WooCommerce plugin, a widely used eCommerce platform for WordPress.

- Connects WooCommerce websites with Paddle, enabling secure and smooth processing of one-time and recurring payments for physical and digital goods.

- Offers features like convenient checkout experiences, international tax handling, and robust subscription management tools specifically designed for WooCommerce environments.

Essentially, both Paddle for EDD and Paddle for WooCommerce leverage the benefits of the Paddle payment gateway but make them readily accessible and enhance their functionality within the familiar interfaces of EDD and WooCommerce, respectively. This makes them ideal choices for WordPress users already comfortable with these plugins and wanting powerful payment solutions without leaving their preferred platform.

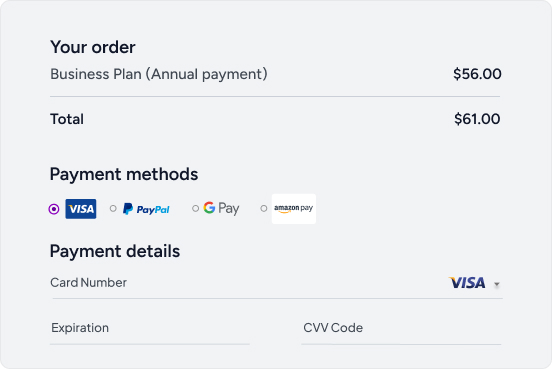

Supported Payment Methods

Paddle: Embraces inclusivity with a vast array of payment options, spanning over 200 currencies, credit and debit cards, popular e-wallets like PayPal and Apple Pay, and even adaptable local payment methods like SEPA Direct Debit and Sofort. This global embrace caters to diverse customer preferences and smooths out cross-border transactions.

Square: Offers a wide range of payment acceptance options to meet the needs of different businesses. This includes in-person payments via magstripe, chip, and contactless methods like Apple Pay and Google Pay. Online payments can be accepted through hosted checkout pages, virtual terminal, ecommerce integrations, and mobile apps. Square also supports digital wallets like Cash App, invoicing with pay-by-link, QR codes, gift cards, and buy-now-pay-later solutions like Afterpay.

Global Reach

Paddle: Champions borderless commerce with its ability to facilitate sales in over 200 countries. It excels in tailoring checkout experiences to local languages and preferences, ensuring seamless customer experiences worldwide. This makes it a natural fit for businesses with global ambitions.

Square: While Square started in the United States, it now operates in several countries including Canada, Japan, Australia, and the United Kingdom. However, its global footprint is more limited compared to Paddle.

Square supports payments in multiple currencies within the countries it operates in, but does not provide as many localized checkout experiences and payment method options as Paddle across 200+ countries. For businesses looking to sell internationally, Square may have some gaps in its global reach compared to more internationally-focused payment providers like Paddle.

Currency Conversion

Paddle: Excels in streamlining international transactions with automatic currency conversion at competitive rates. This alleviates manual calculations and potential pricing errors, fostering a smooth shopping experience for global customers.

Square: Supports accepting payments in multiple currencies within the countries it operates in. However, Square does not provide automatic currency conversion at checkout like Paddle does. Businesses selling internationally with Square would need to manually set pricing in each currency they want to accept payments in.

This makes Paddle’s automatic currency conversion capabilities more seamless for global sales compared to the manual currency management required with Square across different countries and regions. Square’s currency conversion functionality is more limited for true multinational selling.

Fraud Prevention

Paddle: Prioritizes transaction security with advanced fraud detection tools and real-time risk analysis. It proactively identifies and blocks suspicious activity, safeguarding businesses and customers from potential financial losses.

Square: Employs robust fraud prevention measures including machine learning models that monitor payments across its ecosystem to detect and block fraudulent transactions. Its Risk Manager tool provides insights into potentially risky payments and allows businesses to set custom alerts and block rules. Square also has end-to-end encryption and data protection protocols in place.

Chargeback Management

Paddle: Provides valuable assistance in chargeback resolution, mitigating the complexities of disputed transactions. It also attempts to retry declined transactions automatically, potentially reducing lost sales and streamlining payment processes.

Square: Offers expert dispute assistance to help businesses navigate the chargeback process when customers initiate disputes on card payments. Square’s team can coordinate with the bank and card network on the merchant’s behalf to submit documentation and advocate for resolving disputes. Merchants can also track active disputes and receive notifications through Square’s dashboard.

However, Square does not appear to have automatic retry functionality for declined transactions like Paddle offers. Overall, Square provides solid chargeback management support but may lack some of the advanced automatic resolution tools Paddle has built specifically for digital/online transactions.

Reporting and Analytics

Paddle: Paddle offers rich analytics functionality that is custom-built for subscription businesses via its embedded ProfitWell Metrics solution. Companies can easily benchmark key SaaS metrics like MRR, churn, and LTV against an anonymized dataset of 30,000+ subscription companies.

Granular segmentation, predictive modeling for at-risk accounts, and API access further enable data-driven decisions around pricing, retainment campaigns, expansion opportunities etc. Crucially, the unified data consolidated across the payments platform eliminates the need for standalone analytics just for reporting.

Square: Provides robust reporting and analytics tools to help businesses track sales performance, understand customer behavior, and make data-driven decisions. Key reports include sales reports with breakdowns by product, category, staff, and more, as well as insights into traffic trends and labor costs.

For more advanced analytics needs, Square offers premium subscription plans like Square Analytics Plus that provide deeper insights into areas like customer behavior, item performance, multi-location data, and exporting/integrating data.

However, Square’s analytics capabilities are more generalized across retail, food/beverage, and service businesses.

Integrations

Paddle: Boasts a robust library of integrations with popular eCommerce platforms like WooCommerce and Shopify, CRMs like Salesforce, marketing tools like Mailchimp, and more. This seamless integration ecosystem simplifies workflows and automates tasks, boosting efficiency and productivity. Additionally, there are 3rd party software such as Paddle for EDD and Paddle for WooCommerce which seamlessly integrate with their respective platforms, simplifying workflows for WordPress users.

Square: Offers a wide range of integrations to extend its functionality and connect with other business tools businesses may be using. This includes integrations with:

- E-commerce platforms like Wix, Weebly, BigCommerce for online selling

- Accounting software like QuickBooks, Xero, FreshBooks for syncing sales data

- Team/Staff management tools like Deputy, Homebase

- Marketing platforms like Mailchimp, Constant Contact

- Inventory management solutions

- Kitchen display systems for restaurants

- And many more third-party app integrations available through Square’s App Marketplace

While not as extensive as Paddle’s integrations tailored for digital/e-commerce, Square covers a broad set of integrations to create a connected ecosystem for retail, food/beverage, service providers and other business verticals it serves. The available integrations allow businesses to sync their Square data across other operational tools.

Distinct Features of Paddle and Square

Paddle

VAT Compliance Built-in: Imagine the headache of navigating VAT complexities across Europe. Paddle takes the sting out by automating VAT calculations and reporting, ensuring compliance and eliminating the risk of costly mistakes. This is a game-changer for businesses selling in the EU, especially for those without dedicated tax expertise.

Subscription Management Tools: Recurring revenue is the lifeblood of many businesses, and Paddle understands this. Its powerful subscription management tools empower you to create flexible pricing plans, tailor customer journeys, and implement strategic churn reduction strategies to keep your subscription base thriving. No more clunky third-party integrations or manual headaches; Paddle keeps your recurring revenue engine purring smoothly.

Advanced Data Security Features: Data security is paramount, and Paddle doesn’t mess around. PCI-DSS Level 1 compliance, tokenization, and end-to-end encryption are just some of the features that make Paddle a fortress for your customer data. Rest assured, your transactions and sensitive information are in the safest hands possible.

Square

All-in-One Solution for Omnichannel Selling: Square offers an integrated ecosystem for businesses to sell in-person, online, over the phone, and on the go. Its point-of-sale systems, hardware, ecommerce tools, virtual terminal, and mobile processing create a unified omnichannel experience.

Tailored Solutions by Business Type: Square provides specialized software packages tailored to the needs of different verticals like retail, food & beverage, and service businesses. These include advanced POS features, inventory management, tableside ordering, online booking, kitchen display systems and more.

Hardware Ecosystem: In addition to software, Square offers its own lineup of payment hardware like registers, terminals, readers and stands. This first-party hardware integrates seamlessly with Square’s software platform.

Financial Services: Square goes beyond just payments by offering an ecosystem of financial services tooled for small businesses. This includes free business checking/savings accounts, loans, payroll, and invoicing to manage cash flow.

In-Person, Mobile Payments Focus: While supporting omnichannel, Square has particular strength in mobile, contactless and in-person payment processing for businesses operating in the physical world like retailers, restaurants, and service providers.

Pricing and Fees

One of the most crucial considerations for any business when choosing a payment services provider is costs. Between payment processing rates, platform fees, and additional hidden costs, expenses can quickly pile up. In this section, we examine and compare the pricing models of Paddle and Square.

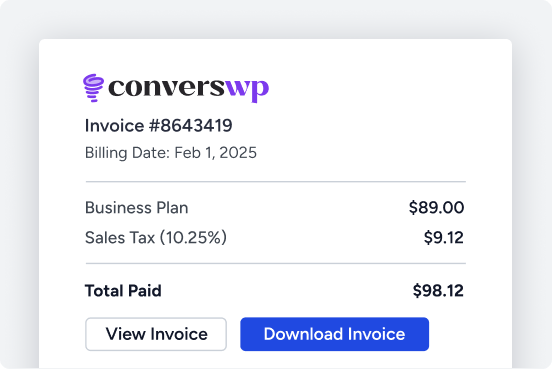

Paddle Pricing

Paddle offers an all-inclusive, transparent pricing model covering payments, subscription billing, tax compliance, fraud protection, and more under one platform. There are no hidden fees or additional costs.

Their pay-as-you-go pricing starts at 5% + 0.50¢ per transaction, delivering essentials like global payments, built-in tax compliance, chargeback protection, and fraud screening.

Paddle provides customized pricing for rapidly scaling or large enterprises to unlock additional premium capabilities like migration services, implementation support, and dedicated success management.

It’s important to note that there are services, Paddle for EDD and Paddle for WooCommerce, that offer customized pricing plans suited for the specific needs of WordPress sites, taking into account transaction volume, subscriptions, and other factors. These services both start at $89/year. For more detailed information visit this link.

Square Pricing

Square adopts a straightforward pricing structure with two main components: transaction fees and optional monthly plans for advanced features. Transaction fees vary based on the payment method:

- In-person transactions (swipe, dip, or tap) cost 2.6% plus 10¢ per transaction,

- Online payments incur a fee of 2.9% plus 30¢ per transaction,

- Manually entered payments are charged 3.5% plus 15¢ per transaction

- Invoices are processed at 3.3% plus 30¢ per transaction.

Square’s optional monthly plans, starting at $29 per month, unlock advanced features such as inventory management, appointment booking, payroll processing, team management, loyalty programs, and advanced reporting.

Additionally, Square offers point-of-sale hardware, including the Square Register, Square Stand, and Square Terminal, for purchase or monthly installments.

While Square aims for transparency, there are potential additional costs to consider, such as a $15 chargeback fee for each successful chargeback, international transaction fees for processing foreign currencies, and PCI compliance fees depending on your business volume.

For startups, the free plan with basic transaction fees is ideal, while paid plans offer advanced features for growing businesses. When accepting in-person payments, businesses should also factor in the cost of hardware.

Ease of Use and Support

When evaluating a billing and payment platform, ensuring a positive user experience through intuitive interfaces and helpful resources is key. Both Paddle and Square emphasize simplifying processes to reduce friction for merchants across global tax compliance, subscription management, payouts and beyond.

For Paddle, easy-to-configure billing models, actionable customer insights, tailored gaming monetization features, and localized checkout experiences are top strengths that underpin their commitment to user-focused design principles.

Testimonials from CEOs attribute considerable operational efficiencies and cost savings to Paddle’s ability to minimize billing administration overheads. Access to ongoing revenue metric benchmarking against wider industry subscription data also provides data-driven assistance.

Square offers a similarly robust and user-friendly experience. Its straightforward pricing structure and easy-to-use point-of-sale systems make it a favorite among small and medium-sized businesses.

Square’s platform includes a range of features designed to simplify operations, such as inventory management, appointment booking, and advanced reporting. Users can benefit from the intuitive interfaces of Square’s hardware, including the Square Register, Square Stand, and Square Terminal, which are designed to streamline in-person transactions.

Moreover, Square provides extensive support resources, including detailed guides, tutorials, and customer support to assist merchants in maximizing the platform’s potential. The seamless integration of these tools and resources helps businesses reduce administrative overheads and focus on growth.

Testimonials from users highlight how Square’s integrated solutions have helped them save time and increase efficiency, making it easier to manage various aspects of their business from a single platform.

Security and Compliance

With payment platforms processing valuable customer data, having rigorous security protocols and compliance with privacy regulations is non-negotiable. We examine how Paddle and Square stack up on key parameters of trust and transparency for customers.

Paddle offers best-in-class security reinforced through adhering to SOC 2, GDPR standards, undergoing regular pentests/audits, and being PCI DSS Level 1 certified – the most stringent level. Their security portal offers in-depth documentation around policies, procedures, recovery metrics, access control, and development practices.

With AWS cloud hosting, role-based access controls, MFA authentication, and advanced threat monitoring via SIEM systems, they check all the boxes for enterprise-grade security. A dedicated security team and proactive vulnerability disclosure program further underpin their mature posture.

In comparison, Square also prioritizes security and compliance, providing a robust framework to protect customer data. Square is PCI DSS Level 1 compliant, ensuring the highest level of security for payment processing.

They use end-to-end encryption and tokenization to safeguard transaction data, minimizing the risk of breaches. Square’s secure data centers and regular security audits further enhance their protective measures. Additionally, Square adheres to GDPR and other privacy regulations, offering transparency and control over data usage to their customers.

Square’s security features include multi-factor authentication (MFA), role-based access controls, and continuous monitoring for suspicious activity. Their dedicated security team actively monitors for vulnerabilities and works to address potential threats promptly.

Square also provides comprehensive support and resources to help businesses maintain compliance and protect their customers’ data.

Overall, both Paddle and Square demonstrate a strong commitment to security and compliance, ensuring that businesses can trust their platforms to handle sensitive information securely and transparently.

Use Cases and Recommendations

With a detailed analysis of core capabilities, security, pricing, and ease of use behind us – we wrap up with recommendations on ideal customer profiles who stand to benefit the most from Paddle and Square’s respective offerings.

Businesses Who Are Best Suited for Paddle

Given its robust feature set and premium pricing, Paddle shines best for well-established businesses with complex global operations including:

- Mid-market to enterprise SaaS companies earning over $10M+ in revenue

- Gaming studios with 50,000+ users and multi-SKU monetization

- Digital publishers generating high 6-7 figure subscription income

- WordPress-based eCommerce and digital download businesses. Paddle for EDD and Paddle for WooCommerce are tailor-made for these platforms, offering powerful features and seamless integration to help your WordPress site thrive

Specifically, the ability to customize sophisticated subscription billing constructs, executive sales tax calculations across 200+ countries, and tap detailed cross-border consumer spending data make Paddle worthwhile for expanding companies.

Those needing niche accommodations like metered pricing models for API usage, certificate generation for software licenses, or risk management around fluctuating cross-border tax jurisdictions will find that they have unmatched capabilities with Paddle.

Ideal Users for Square’s Platform

On the other hand, Square is particularly well-suited for small to medium-sized businesses seeking a user-friendly and cost-effective solution for in-person and online transactions.

- Startups and budding entrepreneurs: The free plan with basic transaction fees allows them to test the waters and manage payments without upfront costs.

- Small to medium-sized businesses (SMBs): Square offers a variety of affordable paid plans with features that cater to the specific needs of retailers, restaurants, and service-based businesses.

- Brick-and-mortar stores with an online presence: Square’s point-of-sale hardware seamlessly integrates with online sales, creating a unified omnichannel experience for customers.

- Freelancers and independent contractors: Square allows for easy invoice creation and secure online payments, streamlining the collection process.

- Businesses with limited technical expertise: Square’s intuitive interface and user-friendly setup make it easy to navigate even for non-technical users.

Focus on Simplicity and Accessibility

Square prioritizes simplicity and accessibility, making it a great fit for businesses that don’t require the complex subscription billing features or global tax compliance automation offered by Paddle. The variety of hardware options cater to businesses that need to accept in-person payments, while the free plan and affordable paid tiers make it a cost-effective solution for businesses of all sizes.

When Paddle Might Be a Better Choice

While Square offers a comprehensive solution for many businesses, consider Paddle if you:

- Need advanced subscription billing features and automation.

- Operate in multiple countries and require robust tax compliance tools.

- Generate high-volume sales or require custom pricing models.

- Have a large team and require complex user permission management.

Summing up….

Choosing between Paddle and Square ultimately depends on your business’s specific needs and scale. Paddle is tailored for established, high-revenue enterprises with complex global operations, offering sophisticated subscription billing, extensive tax compliance, and robust analytics.

Its specialized features make it a powerful tool for mid-market to enterprise SaaS companies, gaming studios, digital publishers, and WordPress-based eCommerce businesses.

On the other hand, Square stands out as a versatile and user-friendly solution ideal for small to medium-sized businesses.

With straightforward pricing, comprehensive point-of-sale hardware, and advanced features like inventory management and appointment booking, Square simplifies payment processing and daily operations for retail stores, restaurants, service providers, and small online businesses.

Both platforms prioritize security and compliance, ensuring businesses can confidently handle sensitive data.

Whether you’re looking for Paddle’s advanced capabilities for complex billing scenarios or Square’s ease of use for seamless in-person and online transactions, both platforms offer valuable tools to support and grow your business. By carefully assessing your business needs and goals, you can choose the platform that best aligns with your operational requirements and growth strategy.