Ecommerce is bigger now than ever. By 2025, the world’s web sales could beat many, many billions of dollars. This gives big chances to those who start companies, those who make ads, and those who create online content.

However, with this significant rise, there’s a key question to ask: how do you ensure you receive your money safely, well, and on time?

Look to your payment handler, the hidden force in every deal. A good checkout keeps buyers pleased, cuts down on people leaving without buying, and makes running your business smoother.

In this guide, we’ll break down the best payment processing solutions for 2025, with a focus on platforms that integrate seamlessly with WordPress-based ecommerce stores.

Two standouts, Paddle for WooCommerce and Paddle for Easy Digital Downloads (EDD). Lead the pack due to their automation, compliance, and seller-first approach.

But we’ll also cover PayPal, Stripe, Google Pay, Apple Pay, and more, helping you make a smart choice for your business.

What’s Ecommerce Payment Processing?

At its heart, it’s how cash moves from your buyers to you. It’s more than a card swipe or a click. A good payment processor works hard in the back, taking payments via cards, digital wallets, bank transfers, and even new ways like Buy Now, Pay Later or crypto.

It checks and OKs deals fast to stop fraud, makes sure private data is safe with strong rules and secret codes and handles refunds, fights, and money taken back well.

Plus, it deals with many types of money for worldwide sales and sets up autopay for things like subs or memberships.

In short, your payment handler is not just a tool, it’s the key money part of your online shop. Picking the right one can really help or hurt your shop’s growth.

Key Criteria for Choosing a Payment Processor

With so many options in 2025, how do you pick the best one? Here are the most important factors:

- Costs & Fees: Some take a set monthly fee, others take a cut for each sale or both. Think hard about other fees, like for refunds or global sales. Small hidden costs can pile up quickly.

- Safety: Look for signs of good security, scam watch, and solid rules for handling fights.

- Trust: People buy with ease when they know the payment method. Stores need processors they can count on for steady work and sure pay.

- Payment Types: Can it work with cards, wallets, BNPL, plans, or other ways like digital money? Having many choices can push up sales.

- Global Help: If you sell all over, make sure it can take many types of money, pay options, and follows tax rules like VAT/GST.

- Easy to Join: Does it mesh well with WooCommerce, EDD, Shopify, or your own site setup? Bad fits can waste time and cause trouble.

- Help for You: Good and quick help, when things go wrong, can keep costs down and cut stress.

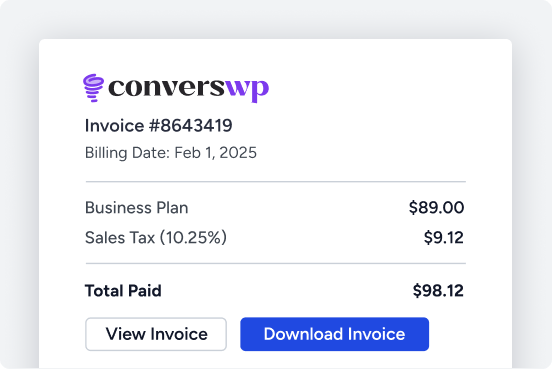

1. Paddle for WooCommerce (by WPSmartPay)

Paddle is the top choice for those who sell digital products, SaaS, and software on WooCommerce. It’s different from Stripe or PayPal because Paddle is the Merchant of Record.

It deals with VAT, taxes, fraud, and chargebacks for you. This is very good for businesses that sell all over the world.

Key Features:

- Easy to combine with WooCommerce.

- Manages both subscriptions and single payments with ease.

- Automatic VAT and sales tax compliance worldwide.

- PCI-compliant fraud protection and dispute management.

- Instant refund synchronization.

- License and coupon management built-in.

Pricing: Low price for each site with WPSmartPay, starting from $89.

Best For: SaaS groups, help firms, online makers, and any company that wants rules to be set easily and fast.

Why You’ll Love It: Imagine launching a new software subscription without worrying about tax filings in 30 countries. Paddle handles it all, letting you focus on growth and product development.

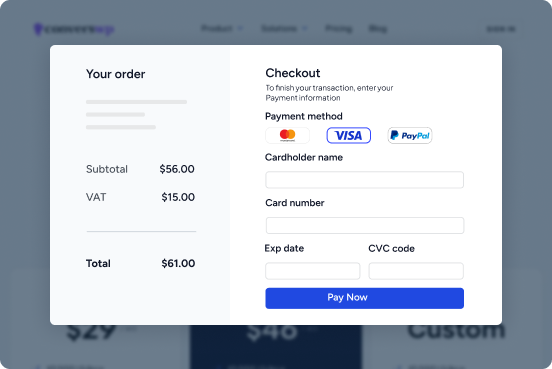

2. Paddle for Easy Digital Downloads (EDD

For those using WordPress to sell digital items, Paddle for Easy Digital Downloads (EDD) changes the game.

It makes the buying path smoother and fixes many online sales pains such as license and tax issues. Paddle lets you grow your work with less focus on the small stuff.

Key Features:

- Works well with EDD to manage digital items easily.

- Popup cart and smooth buy path cut lost sales.

- Auto tax work and pay in many places.

- Quick money back, safe licenses, and deal control.

Cons:

- Only for digital goods, not for real stuff.

Pricing: Competitive annual licensing, starting from $89.

Best For: Agencies, software vendors, and creators who sell digital products and want compliance and payment automation handled automatically.

3. PayPal

PayPal has been well-known for years, giving buyers quick trust when they buy things online.

Its wide reach and name for being safe to make it a top pick for many online shops, mostly for sellers who wish to up their sales with a known and trusted way to pay.

Key Features:

- Easy one, tap buys with PayPal, Venmo, and PayPal Credit.

- Works in over 200 places with 25+ money types.

- Manages repeat pays and bills for subscriptions.

- Strong scam safety and tools for fights between buyers and sellers.

Cons:

- Costs more to buy from other places and to change money.

- Accounts may get locked at times, which can slow down the flow of money.

Pricing: For domestic transactions for goods and services, the fee is typically 2.9% + a fixed fee. And in international transactions, the percentage can be higher (4.4% + fixed fee)

Best For: General ecommerce stores seeking familiarity and broad trust.

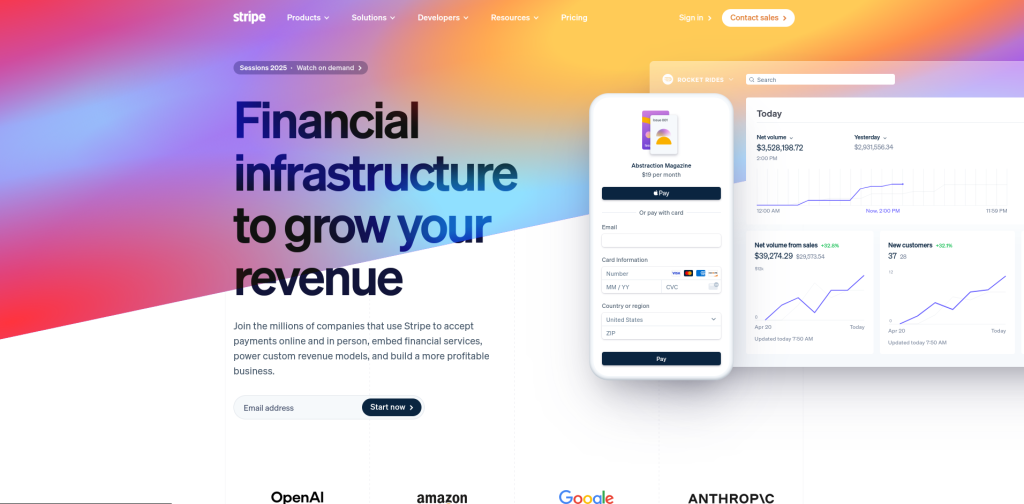

4. Stripe

Stripe is well-known among code experts and sharp business minds for its easy tweaks and strong API skills.

If you have a one, of, a, kind site or need a very made-to-fit paycheck, out, Stripe lets you make nearly any payment method you can dream of, which is great for big online shops.

Key Features:

- Good APIs and easy-to-fit checkouts for made-to-fit setups.

- Works with more than 135 types of money and many ways to pay, like Apple Pay and Google Pay.

- Safe from fraud risks with PCI, ok safety.

- Can do repeat pay, plans to pay over time, and tools for billing.

Cons:

- It might be hard for new users without tech know-how.

- In some cases, your account may freeze or be put on hold.

Pricing: Stripe’s standard fee for online card transactions is 2.9% plus $0.30 per transaction.

Best For: Developers, businesses with plans you pay for over time, and shops that need deep changes

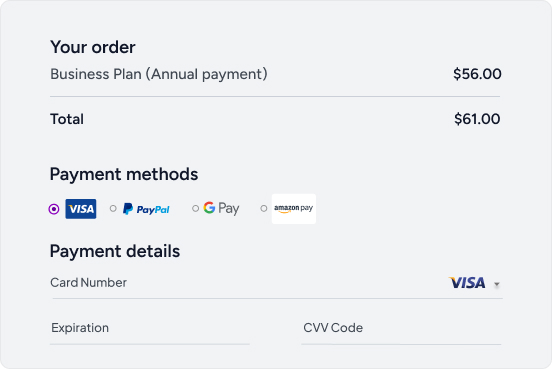

5. Google Pay

![Best Payment Processing Solutions for ecommerce [2025] 1](https://wpsmartpay.com/wp-content/uploads/2025/08/Screenshot-from-2025-08-18-11-13-09-1024x504.png)

Google Pay is an easy pick for Android fans and Chrome users. It makes paying smooth and safe, without the need to put in card info by hand, which cuts down on hassle and speeds up buying.

Key Features:

- Allows safe sign, in with PIN, face, or finger scan, or unlocking the phone.

- Works with both Android and iOS phones for buying online.

- No extra fees, just the usual bank or card charges.

- Fits well with most big online sale sites.

Cons:

- Not as many people use it as PayPal or Stripe.

- Not the best if it’s the only way to pay for people all over the world.

Pricing: Free to use, but bank and credit card fees may apply.

Best For: Mobile-first businesses targeting Android users.

6. Apple Pay

Apple Pay lets you pay quickly and safely if you use iOS. It has a one-click pay thing that’s super simple because of Touch ID or Face ID, so it really helps sellers get more sales from people who use Apple stuff.

Key Features:

- Really quick pay with Touch ID or Face ID.

- Takes credit or debit cards from big banks.

- Safe buys are sure since it has built-in token things.

- It runs on the web, in apps, and in shops where Apple Pay works.

Cons:

- Only works on Apple gear.

- Must work with another service to reach more folk

Pricing: Free to use, though standard bank or credit card charges may apply.

Best For: Online stores with a large iOS customer base.

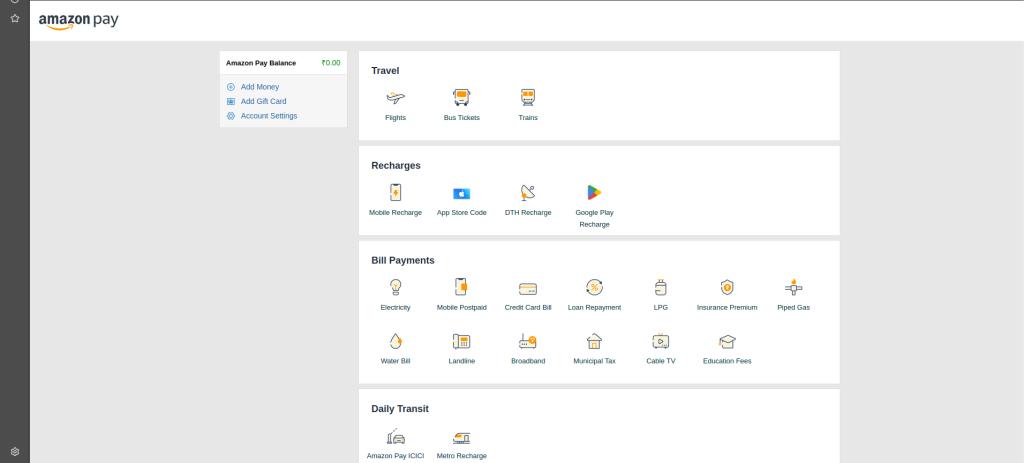

7. Amazon Pay

Amazon Pay uses the well-known and trusted Amazon accounts, letting buyers pay fast without having to type in billing or shipping info. This can build more trust and make things smoother, mainly where Amazon is well-known.

Key Features:

- Fast, easy checkout with Amazon info you already have.

- Safe from fraud and keeps payments secure.

- Let’s you handle repeated payments and subscriptions.

- Known worldwide, which helps gain buyer trust.

Cons:

- Not many use it beyond the US and UK.

- Costs might be more than other payment options.

Pricing: The service is free to use; however, bank and credit card processing fees may apply.

Best For: US/UK ecommerce stores with Amazon-savvy customers.

8. Square

![Best Payment Processing Solutions for ecommerce [2025] 2](https://wpsmartpay.com/wp-content/uploads/2025/08/Screenshot-from-2025-08-18-11-19-04-1024x512.png)

Square is a great pick for firms that run both in-store and online sales. Its mix of sales, point gear, data study, and web payment tools makes it easy for entrepreneurs who aim to handle every sales path in one system.

Key Features:

- Full POS setup for smooth web and store sales.

- Built-in data studies and reports for business knowledge.

- Helps repeat bills, send bills, and process web payments.

- Simple to run shape with little setup.

Cons:

- Not as good for only web businesses.

- Some top things require you to pay more.

Pricing: Free version available. Pro plan $29+ /mo.( processing fees)

Best For: Omnichannel retailers.

9. Authorize.net

Authorize.net has long been a go, to for big companies when they need to handle payments. It provides strong safety measures and guards against fraud, making it a safe choice for sellers who care about keeping things secure and in line.

Key Features:

- It can spot fraud well and lets you set your own safety rules.

- Has tools to manage regular billing and subscriptions.

- Gives detailed data reports to help understand business trends.

- Let’s you deal with many kinds of money and international payments.

Cons:

- The cost each month might be too much for small firms.

- It can be hard to set up for new or non-tech folks.

Pricing: Starting from $25 per month. 2.9% + 30¢ per transaction

Best For: Established enterprises with robust transaction volume.

10. Braintree (by PayPal)

Braintree, made by PayPal, is a flexible, easy, to, use tool that lets sellers offer lots of ways to pay while keeping it safe. It has a strong API and many ways to join it, perfect for firms that want to shape how they check out.

Features:

- It takes many ways to pay: Venmo, Apple Pay, Google Pay, and cards.

- Top APIs for custom joins and smooth checkout.

- Manages recurring bills, subscriptions, and sends bills.

- Tools to stop fraud and safe PCI, ok processing.

Cons:

- A bit harder to learn than PayPal.

- Help can be slow for smaller sellers.

Pricing: Per transaction for merchants is 2.9% of the transaction amount plus 30 cents

Best For: Developers and PayPal users seeking more flexibility.

Feature Comparison Table

| Processor | Global Reach | Subscriptions | Tax Compliance | Ease of Setup | Best For |

|---|---|---|---|---|---|

| Paddle for (Woo) | ✅ | ✅ | ✅ | Easy | SaaS, digital, global sellers |

| Paddle for (EDD) | ✅ | ✅ | ✅ | Easy | Digital goods, agencies |

| PayPal | ✅ | ✅ | ❌ | Easy | General ecommerce |

| Stripe | ✅ | ✅ | ❌ | Moderate | Developers, custom setups |

| Google Pay | ✅ | ❌ | ❌ | Easy | Android/Chrome users |

| Apple Pay | ❌ | ❌ | ❌ | Easy | iOS users |

| Amazon Pay | Limited | ✅ | ❌ | Easy | US/UK ecommerce |

| Square | ✅ (POS) | ✅ | ❌ | Easy | Retail + online |

| Authorize.net | ✅ | ✅ | ❌ | Complex | Enterprise |

| Braintree | ✅ | ✅ | ❌ | Moderate | Developers, PayPal users |

Choosing the Best Payment Processor

- Know What You Sell: Are you offering real items, digital items, or help? Do you charge one time or again and again?

- Find Who Buys: What ways to pay and types of money might your buyers most likely pick?

- Check if it Fits: Make sure your setup, whether it’s WooCommerce, EDD, Shopify, or another platform, works well.

- Look at Safety Needs: Selling to other countries? Make sure to meet safety rules, stop fraud, and handle taxes right.

- Weigh Costs and Gains: Don’t just eye the fees per sale; think about rule following, help, and ease of use too.

- Try their Help: Talk to help teams before you choose. Good help now often means good help later.

Unique Advantages of Paddle Integrations (WPSmartPay)

As an e-commerce payment processing solution, Paddle is special because it is a Merchant of Record. Not like Stripe or PayPal, Paddle takes care of all tax work, VAT rules, stops fraud, and handles chargeback issues.

For businesses that are all online, using Paddle for WooCommerce and Paddle for Easy Digital Downloads saves a lot of time and money. It lets you put all your work into growing, not paperwork.

payment processing solutions for 2025, with a focus on platforms that integrate seamlessly with WordPress-based ecommerce stores.