Key Takeaways

Key Takeaways

- Top Payment Gateways for WooCommerce in 2025 Let us now review the top options available today, highlighting key features, pros, cons, and pricing

In the rapidly evolving world of eCommerce, choosing the right payment gateway for WooCommerce is one of the most important decisions you will make.

The payment gateway you select directly impacts your customers’ checkout experience, your conversion rates, and your ability to comply with global financial regulations.

As we move through 2025, the payment landscape is becoming more competitive and diverse, with both well-established giants and innovative newcomers offering advanced features.

Among these, Paddle stands out as a powerful full-stack payment platform tailored for SaaS, digital products, and subscription businesses.

This comprehensive guide will walk you through the best payment gateways for WooCommerce this year.

You will learn about their unique features, pricing, geographic reach, and how they fit different types of businesses.

We will dive deep into the offerings from Stripe, PayPal, Square, Authorize.Net, Amazon Pay, WooPayments, and Paddle to help you make an informed choice that future-proofs your online store’s payment infrastructure.

Why Your WooCommerce Payment Gateway Choice Matters in 2025

Before jumping into the list of payment gateways, let us explore why this choice is so critical for WooCommerce merchants.

1. Seamless Checkout Experience

Your payment gateway is the final step before customers complete their purchase. If the checkout process is slow, confusing, or unreliable, shoppers are likely to abandon their carts.

A smooth, intuitive checkout process that supports multiple payment methods and digital wallets like Apple Pay and Google Pay enhances customer satisfaction and boosts sales.

2. Global Reach and Currency Support

With eCommerce becoming truly global, having a payment gateway that supports a wide range of currencies and payment methods is essential.

If your store targets customers across multiple countries, you need a gateway that accepts local payment options and handles currency conversions transparently.

3. Security and Compliance

Security is paramount in online payments. Your gateway should comply with industry standards such as PCI-DSS and use fraud prevention tools like 3D Secure authentication.

In addition, with varying tax laws worldwide, gateways that assist with tax compliance can save you significant administrative headaches.

4. Subscription and Recurring Billing Support

Many WooCommerce merchants sell subscriptions or offer recurring billing. Your payment gateway must integrate well with WooCommerce Subscriptions or similar extensions to automate billing cycles and reduce churn.

5. Transparent Pricing and Fees

Understanding your payment gateway’s fee structure is vital. Some gateways charge a fixed rate per transaction while others offer all-inclusive pricing.

International transactions often incur extra fees, so choose a gateway that aligns with your sales model and geography.

Top Payment Gateways for WooCommerce in 2025

Let us now review the top options available today, highlighting key features, pros, cons, and pricing.

1. Paddle

Paddle is a full-stack payment platform increasingly recognized as a game-changer for SaaS, digital products, and subscription businesses.

Paddle offers official plugins including Paddle for WooCommerce, which provides seamless integration to your WooCommerce store.

This plugin supports Paddle’s latest Billing API and real-time billing updates, enabling smooth subscription management and checkout experiences.

Key Features

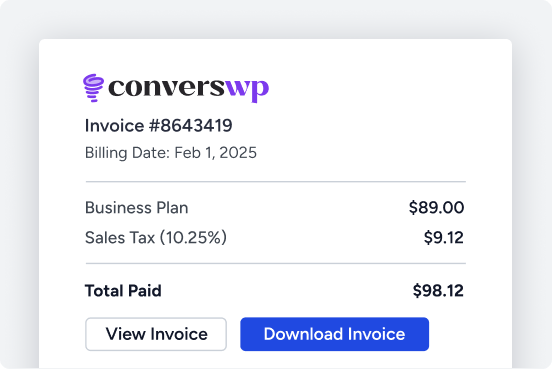

- Operates as a Merchant of Record handling payments, subscriptions, tax compliance, and fraud management all in one platform.

- Sell globally in 200+ countries with support for 200+ currencies.

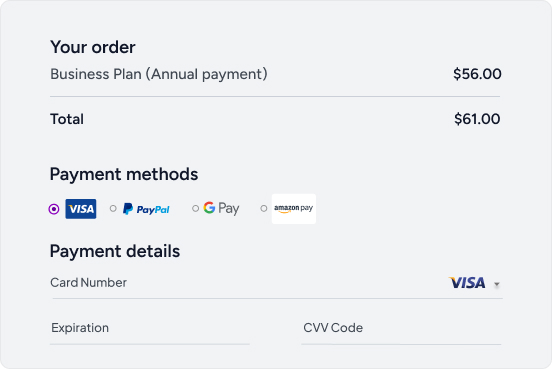

- Accepts credit and debit cards, PayPal, Venmo, Apple Pay, Alipay, SEPA, and more.

- Advanced recurring billing, churn reduction tools, and flexible pricing plans.

- Automatically manages VAT, GST, and sales tax, reducing your compliance burden.

- PCI-DSS compliant with advanced fraud prevention and data encryption.

- Mobile-optimized, distraction-free checkout with one-click payments and pop-up windows.

- Deep insights powered by ProfitWell Metrics for actionable analytics.

- Pricing is all-inclusive and varies depending on volume and features, differing from traditional per-transaction fees.

- 5% + 50¢ per Checkout transaction

Pros

- Complete all-in-one payment, tax, and compliance platform

- Ideal for SaaS and digital product sellers with global audiences

- Easy to set up with official WooCommerce plugins like Paddle for WooCommerce

- Strong fraud prevention and subscription management tools

Cons

- Less customizable than Stripe for highly tailored payment flows

- Some features require technical knowledge to configure

- Pricing model may differ from expectations for traditional gateways

Best For

SaaS companies, digital product sellers, and subscription-based WooCommerce stores seeking a globally compliant, streamlined checkout and billing platform.

2. WooPayments

WooPayments is the official WooCommerce-native payment gateway, built to provide deep integration and simplicity for store owners.

Key Features

- Direct dashboard integration for payments, refunds, and disputes

- Supports 135+ currencies

- Accepts Apple Pay and Google Pay

- Works seamlessly with WooCommerce Subscriptions

- PCI-compliant with Stripe-powered fraud protection and 3D Secure

- Domestic Cards (U.S. issued): 2.9% + $0.30 per transaction.

- International Cards (or currency conversion): 3.9% + $0.30 per transaction

Pros

- Native integration with WooCommerce makes setup and management easy

- Supports a broad range of currencies for international sales

- Strong security features backed by Stripe technology

Cons

- Limited availability in certain countries

- Some users report occasional delays in deposit times

Best For

Small to medium WooCommerce stores looking for a simple, reliable payment solution tightly integrated with WooCommerce.

3. Stripe

Stripe remains one of the most flexible and widely-used payment gateways worldwide.

Key Features

- Available in 45+ countries supporting 135+ currencies

- Supports cards, Apple Pay, Google Pay, ACH, SEPA, and other payment methods

- One-click checkout, saved cards, and subscriptions support

- Advanced fraud protection tools and customizable APIs

- Fees start at 2.9% plus 30 cents per transaction in the US, with variable international rates

Pros

- Highly customizable with robust API for bespoke payment flows

- Extensive global reach and support for many payment types

- Well-established and trusted platform with solid developer documentation

Cons

- Account freezes have been reported by some users

- Not supported in every country, so availability depends on your location

Best For

Merchants who want flexibility and plan to scale internationally or build custom payment experiences.

4. PayPal Payments

PayPal remains one of the most recognized and trusted payment platforms in the world.

Key Features

- Supports 25+ currencies and various payment methods including PayPal balance, bank accounts, credit cards, PayPal Credit, Pay Later, and Venmo (US only)

- Simple WooCommerce plugin for quick setup

- Buyer and seller protection along with end-to-end encryption

- Standard fee of 2.9% plus 30 cents per US transaction, with higher fees for cross-border payments

Pros

- Instant brand recognition boosts buyer confidence

- Versatile payment options including financing solutions

- Simple setup with official WooCommerce integration

Cons

- Occasional account holds and freezes reported

- Cross-border transaction fees can be higher compared to other gateways

Best For

Stores targeting US customers and those wanting a widely trusted payment method with financing options.

5. Square

Square is a hybrid payment platform designed for both online and physical retail.

Key Features

- Supports Apple Pay and Google Pay

- Synchronizes inventory and sales between online and physical stores

- Funds typically available within 1-2 business days

- Integrates with Square POS for seamless in-person transactions

- Charges 2.9% plus 30 cents per online transaction in the US

Pros

- Ideal for merchants selling both online and offline

- Fast access to funds and unified sales reporting

- User-friendly and widely adopted in the US and Canada

Cons

- Limited country availability

- Some advanced features require paid subscriptions

Best For

Retailers with brick-and-mortar stores who want to unify online and offline payments.

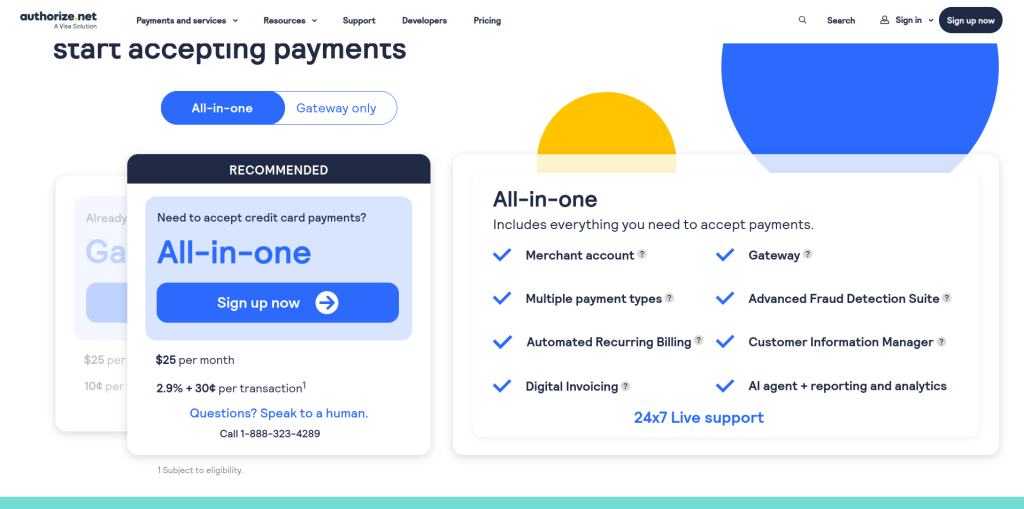

6. Authorize.Net

Authorize.Net caters primarily to high-volume and enterprise-level merchants.

Key Features

- PCI-DSS compliant with advanced fraud detection

- Supports eChecks, recurring billing, and detailed reporting

- Charges 2.9% plus 30 cents per transaction plus a monthly $25 gateway fee

- More complex setup suited for large businesses with dedicated IT resources

Pros

- Enterprise-grade security and fraud prevention

- Robust reporting and eCheck capabilities

- Trusted by many large-scale merchants

Cons

- Setup complexity and higher cost may not be ideal for small businesses

- Monthly fee adds to overall expenses

Best For

High-volume merchants and enterprises requiring advanced payment and security features.

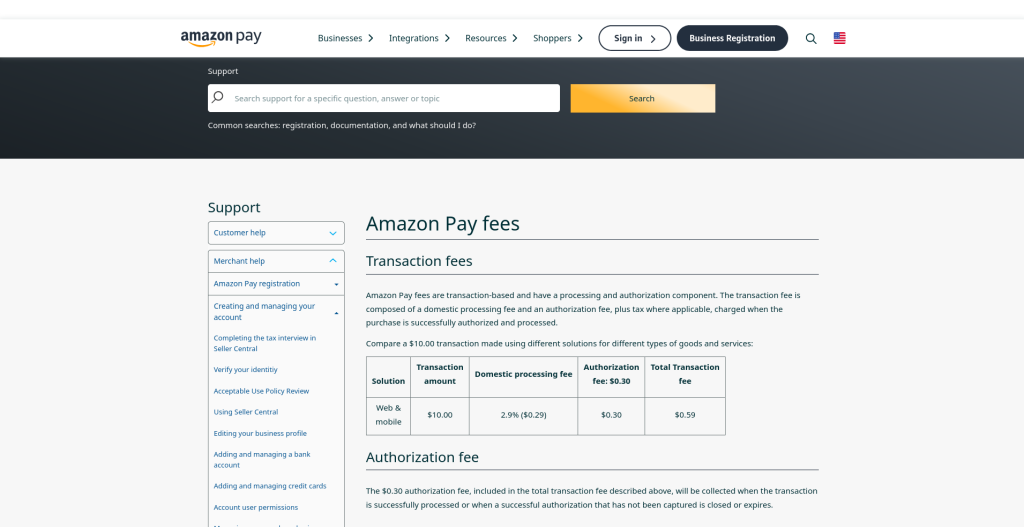

7. Amazon Pay

Amazon Pay leverages Amazon’s vast user base and security infrastructure.

Key Features

- Allows customers to pay with their Amazon accounts

- Employs Amazon-level security and fraud detection

- Official WooCommerce plugin for easy integration

- Standard fee of 2.9% plus 30 cents per domestic transaction

Pros

- Leverages trust and convenience of Amazon for customers

- Simplifies checkout for millions of Amazon shoppers

- High security standards

Cons

- Available only in select regions

- Customers must have an Amazon account to use

Best For

Stores targeting customers who regularly shop on Amazon and want a fast checkout experience.

Comparison Table of WooCommerce Payment Gateways 2025

| Payment Gateway | Currencies Supported | Digital Wallets Supported | Recurring Billing | Fees (US Transactions) | Best For | Geographic Reach | Notable Strengths | Limitations |

|---|---|---|---|---|---|---|---|---|

| Paddle | 200+ | Apple Pay, PayPal, Venmo, Alipay, etc | Yes | All-inclusive, varies | SaaS, digital products, subscription sales | 200+ countries | All-in-one payments, tax, compliance | Less customizable than Stripe |

| WooPayments | 135+ | Apple Pay, Google Pay | Yes | 2.9% + $0.30 + 1% extra for intl. | WooCommerce-native stores, simplicity | Select countries | Native WooCommerce integration | Limited country availability |

| Stripe | 135+ | Apple Pay, Google Pay, Alipay | Yes | 2.9% + $0.30 + varies internationally | Flexible global reach, highly customizable | 45+ countries | Robust API, broad payment methods | Account freezes, not worldwide |

| PayPal Payments | 25+ | PayPal, Venmo | Yes | 2.9% + $0.30 + higher cross-border fees | Trusted brand, easy setup | Worldwide (selected) | Buyer/seller protection, financing | Higher fees on cross-border |

| Square | Region-specific | Apple Pay, Google Pay | Yes | 2.9% + $0.30 | Online + physical retail sales | US, Canada, UK | Unified online/offline sales | Limited countries, extra fees |

| Authorize.Net | 13+ | None | Yes | 2.9% + $0.30 + $25/mo | Enterprise, advanced security | Limited | Enterprise-grade security | Complex setup, costly for small biz |

| Amazon Pay | 12+ | Amazon Pay | No | 2.9% + $0.30 | Amazon shoppers | Select regions | Trusted by Amazon users | Amazon account required |

Comparing the Gateways: What to Look For in 2025

When selecting a payment gateway for your WooCommerce store, consider these essential factors:

Geographic Coverage

Ensure the gateway supports your target markets and currencies. If you sell globally, opt for a solution like Paddle or Stripe that supports a wide international footprint.

Payment Methods and Digital Wallets

Offering popular payment options such as Apple Pay, Google Pay, PayPal, and local methods enhances customer convenience and conversion rates.

Security and Compliance

Choose gateways compliant with PCI-DSS and that provide advanced fraud prevention tools like 3D Secure authentication. For international sellers, tax compliance automation is a big plus.

Recurring Billing and Subscriptions

If your business model relies on subscriptions, recurring billing support is critical. Look for gateways tightly integrated with WooCommerce Subscriptions or that offer built-in tools like Paddle’s subscription management.

Fees and Pricing Model

Understand the total cost including transaction fees, currency conversion charges, monthly fees, and any setup costs. Compare traditional per-transaction pricing versus all-inclusive models.

Integration and Support

Official WooCommerce plugins or well-supported third-party extensions ensure a smooth setup and ongoing support.

Analytics and Reporting

Access to detailed analytics helps optimize payment flows, reduce churn, and make informed business decisions.

Final Thoughts: Which Payment Gateway is Best for Your WooCommerce Store?

For most WooCommerce merchants, WooPayments and Stripe remain the safest bets due to their strong WooCommerce integrations, global reach, and flexibility. They offer a balance of ease-of-use, customization, and extensive currency support.

However, in 2025, Paddle is emerging as a compelling choice for SaaS, digital products, and subscription businesses. Its all-in-one platform simplifies payments, taxes, compliance, and churn management while supporting global sales with localized checkout experiences.

Paddle’s deep analytics and recurring billing tools help digital merchants optimize growth and retention in ways traditional gateways cannot.

PayPal and Square provide reliable alternatives that suit specific needs, such as easy financing or hybrid online/offline selling.

Authorize.Net and Amazon Pay target niches requiring enterprise-grade features or the Amazon shopper base.

Choosing the right payment gateway is a strategic business decision. Assess your store’s sales model, customer base, technical resources, and growth plans carefully.

With the right gateway, you can offer a seamless, secure checkout experience that delights customers and fuels your WooCommerce store’s success.