For any subscription-based startup, navigating the intricacies of payment processing and recurring billing is crucial for sustainable growth. Two key players dominating this space are Paddle and Chargebee, each offering a robust suite of features to cater to the diverse needs of businesses. But with both platforms vying for your attention, choosing the right one can be a daunting task.

This article delves into a comprehensive comparison of Paddle vs Chargebee, analyzing their strengths, weaknesses, and unique offerings to help you make an informed decision as your startup scales its subscription journey. We’ll dive into key strengths around capabilities, integrations, flexibility, and security standards that should steer your evaluation as you shortlist a payment services provider optimized for revenue continuity and global compliance.

What are Paddle and Chargebee?

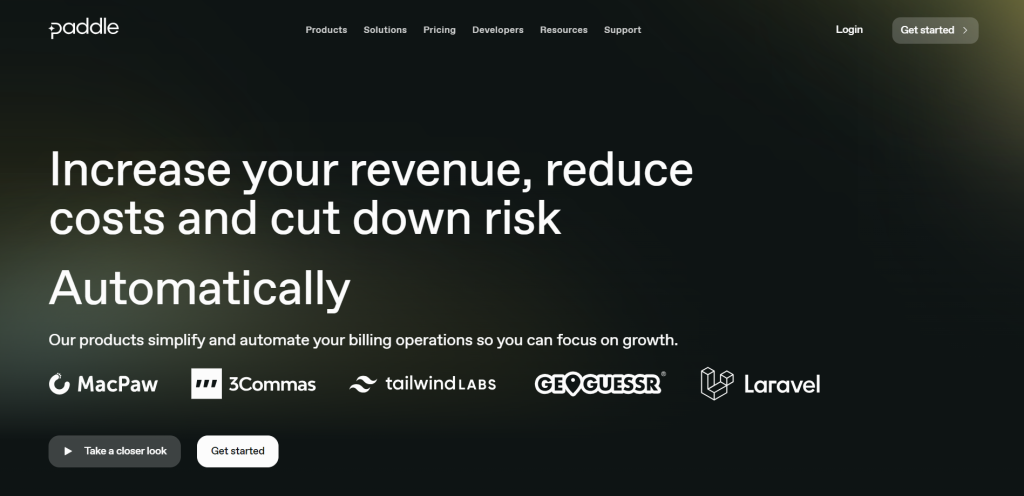

Paddle

Paddle is a robust payment platform that focuses exclusively on providing an end-to-end payments infrastructure tailored for SaaS, software subscription, and digital goods merchants. It excels at handling global sales, including subscriptions, one-time transactions, and complex tax compliance like VAT. Whether you’re a SaaS provider, software platform, or digital product vendor, Paddle offers powerful features and seamless scalability to support your growth.

Key Features

- 5% + 0.50¢ per sale flat rate pricing

- Built-in sales tax compliance for Europe, US, Canada, and Australia

- Fully customizable localized checkout options across 200+ countries and multiple currencies

- Automated VAT collection, filing and verification capabilities

- Focused subscription monetization tools like metered billing and instant license generation

- One-click instant payouts directly to all major banks globally

- Streamlined affiliate program and partner payout management

- Painless transparent platform pricing with sliding fee scale models

Of course, their comprehensive security standards make the list too – PCI DSS Level 1 compliance, bank-level encryption, extensive fraud protection and high service uptime guarantees.

Best Use Cases

- SaaS Companies: Manage global subscriptions and tax complexities effortlessly.

- Software Platforms: Offer secure and convenient purchasing options for digital products.

- Digital Product Vendors: Streamline sales processes and focus on creating amazing products.

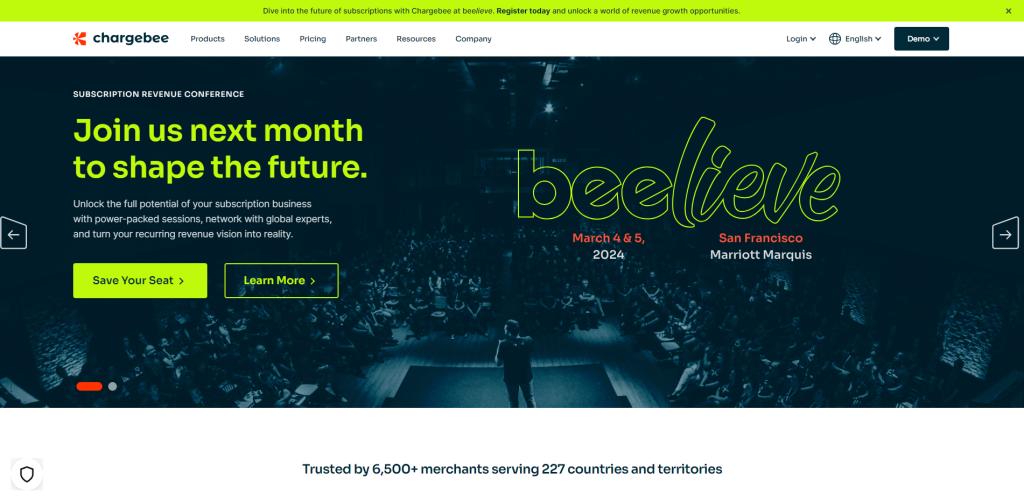

Chargebee

Chargebee is a leading end-to-end revenue management platform specifically designed for businesses operating with a subscription model. It streamlines and simplifies the entire subscription lifecycle, from secure checkout experiences and recurring billing to customer management and revenue recognition.

Key Features

- Flexible pricing plans tailored to your business needs (for your first USD 250K of cumulative billing; 0.75% on billing thereafter)

- Automated subscription billing and invoicing

- Supports payments across 150+ countries and 100+ currencies through 30+ payment gateways

- Built-in support for global tax compliance, including VAT and GST

- Multi-currency and multi-payment gateway support for global transactions

- Recurring billing automation with dunning management for failed payments

- Customizable checkout pages and subscription management portals

- Integrations with popular third-party applications for enhanced functionality

- Advanced analytics and reporting tools for insights into subscription metrics

Security features of Chargebee include PCI DSS compliance and data encryption for enhanced protection

Best Use Cases

- Subscription-based SaaS businesses: Manage recurring subscriptions for software, cloud services, or any product delivered over time.

- E-commerce businesses with subscription models: Offer subscription boxes, memberships, or recurring product deliveries.

- Media and publishing companies: Manage subscriptions for newsletters, magazines, online courses, or other content access.

- Telecom and service providers: Manage recurring billing for services like internet, phone plans, or streaming subscriptions.

Paddle Vs Chargebee: Features and Functionality

Both Paddle and Chargebee are massive services with a plethora of features that require thorough analysis, but before doing a deep dive and looking into every single nook and cranny of these services that are geared for SaaS or eCommerce businesses lets see how they stack up on the surface.

| Features | Paddle | Chargebee |

|---|---|---|

| Target Audience | Ambitious online businesses, SaaS providers, software platforms, digital product vendors, WordPress-based eCommerce and digital download businesses (Paddle for EDD and Paddle for WooCommerce) | Subscription-based businesses, encompassing: Subscription-based SaaS businesses, E-commerce businesses with subscription models, media and publishing companies,Telecom and service providers |

| Global Reach | 200+ currencies, localized checkout experiences | 100+ currencies across 150+ countries with specific focus on regions supported by Chargebee’s tax compliance (US, Canada, Europe, Australia) |

| Subscriptions | Powerful management tools, flexible pricing plans, churn reduction strategies | Focuses primarily on subscriptions with support for trials and various pricing models |

| Tax Compliance | Handles VAT and other regional taxes | Limited built-in tax compliance. May require additional integrations for complex tax requirements |

| Security | Robust PCI-DSS compliance, advanced fraud prevention, data encryption | PCI DSS compliant with various security measures |

| Scalability | Handles high transaction volumes, scales with your business | Scalable platform with various pricing plans supporting 30+ payment gateways to accommodate different business sizes |

| Ease of Use | User-friendly interface, but requires some technical knowledge | May require a learning curve for certain features due to the wider range of functionalities compared to Paddle |

| Built-in Marketing Tools | Limited integrations with marketing platforms | Offers basic marketing tools like dunning management and coupon codes |

| Mobile-First | Mobile-optimized checkout | Provides mobile-friendly checkout options |

| Pricing | 5% + $0.50 per transaction flat rate pricing + potential volume discounts | Various pricing plans based on features and transaction volume (for your first USD 250K of cumulative billing; 0.75% on billing thereafter) |

| Hidden Fees | None | May have additional fees for specific features or exceeding transaction volume limits |

| Integrations | More integrations with eCommerce platforms and tools | Integrates with a wide range of third-party tools for accounting, marketing, customer support, and other functionalities |

| Reporting and Analytics | Robust reporting and analytics capabilities powered by ProfitWell Metrics | Offers comprehensive reporting and analytics dashboards for detailed insights |

| Customer Support | Extensive customer support options | Dedicated customer support team |

Note: If you’re using Easy Digital Downloads or WooCommerce, consider Paddle for EDD and Paddle for WooCommerce. They offer native integrations and optimized features for those platforms, streamlining setup and maximizing your WordPress experience.

Paddle for EDD

- Targets users of the Easy Digital Downloads (EDD) plugin, a popular platform for selling digital products on WordPress.

- Seamlessly integrates Paddle’s powerful capabilities like global payments, subscriptions, tax compliance, and advanced fraud protection within the EDD interface.

- Provides additional features like automatic license generation, discount management, and one-click payouts, all geared towards simplifying and scaling digital product sales through EDD.

Paddle for WooCommerce

- Caters to users of the WooCommerce plugin, a widely used eCommerce platform for WordPress.

- Connects WooCommerce websites with Paddle, enabling secure and smooth processing of one-time and recurring payments for physical and digital goods.

- Offers features like convenient checkout experiences, international tax handling, and robust subscription management tools specifically designed for WooCommerce environments.

Essentially, both Paddle for EDD and Paddle for WooCommerce leverage the benefits of the Paddle payment gateway but make them readily accessible and enhance their functionality within the familiar interfaces of EDD and WooCommerce, respectively. This makes them ideal choices for WordPress users already comfortable with these plugins and wanting powerful payment solutions without leaving their preferred platform.

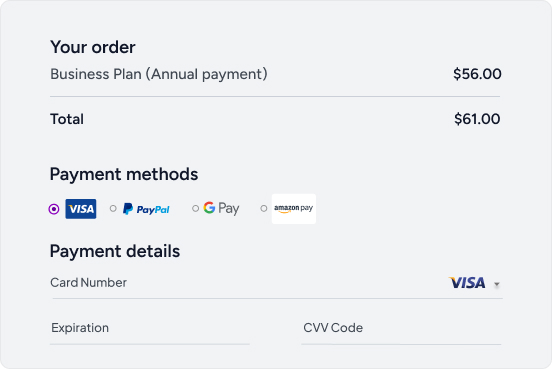

Supported Payment Methods

Paddle: Embraces inclusivity with a vast array of payment options, spanning over 200 currencies, credit and debit cards, popular e-wallets like PayPal and Apple Pay, and even adaptable local payment methods like SEPA Direct Debit and Sofort. This global embrace caters to diverse customer preferences and smooths out cross-border transactions.

Chargebee: While Paddle offers a wider array of payment methods encompassing over 200 currencies, Chargebee still provides a comprehensive selection of popular credit and debit cards, e-wallets like PayPal and Apple Pay, and support for various local payment methods across 150+ countries

However, Chargebee may not match the extensive reach of Paddle’s 200+ currencies, potentially limiting its ability to cater to specific customer preferences in certain regions. It’s crucial to assess your target market and the payment methods commonly used there to determine which platform aligns better with your needs.

Global Reach

Paddle: Champions borderless commerce with its ability to facilitate sales in over 200 countries. It excels in tailoring checkout experiences to local languages and preferences, ensuring seamless customer experiences worldwide. This makes it a natural fit for businesses with global ambitions.

Chargebee: Boasts global reach, similar to Paddle. However, it may not offer the same level of customization and localization for checkout experiences across every region. While Chargebee supports various languages and currencies, Paddle excels in tailoring the entire checkout process to local preferences, potentially leading to a more seamless and familiar experience for customers worldwide.

Currency Conversion

Paddle: Excels in streamlining international transactions with automatic currency conversion at competitive rates. This alleviates manual calculations and potential pricing errors, fostering a smooth shopping experience for global customers.

Chargebee: Facilitates automatic currency conversion for transactions. However, it’s essential to compare the conversion rates offered by both platforms to ensure you’re not incurring unnecessary fees or losing out on potential profit margins. Additionally, Chargebee might not offer the level of transparency and granular control over currency conversion settings compared to Paddle.

Fraud Prevention

Paddle: Prioritizes transaction security with advanced fraud detection tools and real-time risk analysis. It proactively identifies and blocks suspicious activity, safeguarding businesses and customers from potential financial losses.

Chargebee: Implements robust fraud prevention measures, employing various security protocols and risk management tools to safeguard transactions. However, it’s recommended to research and compare the specific details of each platform’s fraud prevention practices to determine which one aligns better with your security requirements and risk tolerance.

Chargeback Management

Paddle: Provides valuable assistance in chargeback resolution, mitigating the complexities of disputed transactions. It also attempts to retry declined transactions automatically, potentially reducing lost sales and streamlining payment processes.

Chargebee: Offers tools to assist in managing chargebacks, including dispute resolution processes and potential mechanisms for recovering disputed funds. However, the level of assistance and automation might be different compared to Paddle’s offerings. It’s essential to delve deeper into each platform’s chargeback management features and policies to understand their respective approaches and choose the one that aligns with your needs.

Reporting and Analytics

Paddle: Paddle offers rich analytics functionality that is custom-built for subscription businesses via its embedded ProfitWell Metrics solution. Companies can easily benchmark key SaaS metrics like MRR, churn, and LTV against an anonymized dataset of 30,000+ subscription companies.

Granular segmentation, predictive modeling for at-risk accounts, and API access further enable data-driven decisions around pricing, retainment campaigns, expansion opportunities etc. Crucially, the unified data consolidated across the payments platform eliminates the need for standalone analytics just for reporting.

Chargebee: Unlike Paddle’s integrated ProfitWell offering with built-in benchmarking and predictive modeling, Chargebee provides a dedicated suite of standalone reporting and analytics tools. While Chargebee lacks built-in benchmarking and may require additional solutions for predictive modeling, it excels in offering highly customizable reports, multi-perspective revenue analysis, and streamlined GAAP-compliant revenue recognition, making it a strong contender for businesses seeking in-depth data insights without relying solely on integrated solutions.

Ultimately, the choice depends on priorities, as Paddle’s offering might be better for benchmarking and predicting at-risk accounts, while Chargebee caters better to businesses seeking a robust set of customizable reporting tools.

Integrations

Paddle: Boasts a robust library of integrations with popular eCommerce platforms like Shopify and WooCommerce, CRMs like Salesforce, marketing tools like Mailchimp, and more. This seamless integration ecosystem simplifies workflows and automates tasks, boosting efficiency and productivity. Additionally, there are 3rd party software such as Paddle for EDD and Paddle for WooCommerce which seamlessly integrate with their respective platforms, simplifying workflows for WordPress users.

Chargebee: Chargebee maintains a robust library of integrations with various business tools, encompassing similar categories like e-commerce platforms, CRMs, marketing tools, and accounting software. It’s crucial to compare the specific integrations offered by each platform to determine which one aligns better with your existing technology stack and business needs.

Additionally, while Paddle offers integrations like “Paddle for EDD” and “Paddle for WooCommerce,” Chargebee might require alternative solutions for integrating with specific platforms. Thorough research and comparison are essential to ensure smooth integration and optimized workflows within your chosen platform.

Distinct Features of Paddle and Chargebee

Paddle

VAT Compliance Built-in: Imagine the headache of navigating VAT complexities across Europe. Paddle takes the sting out by automating VAT calculations and reporting, ensuring compliance and eliminating the risk of costly mistakes. This is a game-changer for businesses selling in the EU, especially for those without dedicated tax expertise.

Subscription Management Tools: Recurring revenue is the lifeblood of many businesses, and Paddle understands this. Its powerful subscription management tools empower you to create flexible pricing plans, tailor customer journeys, and implement strategic churn reduction strategies to keep your subscription base thriving. No more clunky third-party integrations or manual headaches; Paddle keeps your recurring revenue engine purring smoothly.

Advanced Data Security Features: Data security is paramount, and Paddle doesn’t mess around. PCI-DSS Level 1 compliance, tokenization, and end-to-end encryption are just some of the features that make Paddle a fortress for your customer data. Rest assured, your transactions and sensitive information are in the safest hands possible.

Chargebee

Holistic Subscription Management: Chargebee goes beyond basic subscription management, offering a comprehensive platform to streamline the entire subscription lifecycle. This includes features like:

- Automated Revenue Recognition: Simplify revenue recognition by automatically calculating and recognizing revenue based on accounting standards, ensuring accurate financial reporting.

- Dunning Management: Streamline the process of collecting recurring payments with automated dunning emails and retries, minimizing revenue leakage and improving cash flow.

- Self-Service Customer Portal: Empower customers to manage their subscriptions, update payment information, and access past invoices through a user-friendly portal, reducing support workload and improving customer experience.

- Subscription Analytics Dashboard: Gain valuable insights into your subscription health with comprehensive dashboards and reports. Analyze key metrics like MRR, churn rate, and customer lifetime value to inform data-driven decisions and optimize your subscription model.

Flexible and Scalable Platform: Chargebee offers flexible pricing plans to cater to businesses of all sizes, from early-stage startups to established enterprises, ensuring scalability as your business grows. Additionally, its robust API allows for seamless integration with various third-party tools, enabling you to customize your solution and build a unified ecosystem for managing your subscription business.

Advanced Security Features: Chargebee prioritizes security with PCI-DSS compliance and industry-standard security practices, ensuring the protection of your customer data and financial information. Additionally, two-factor authentication and role-based access control provide further security layers to safeguard your platform.

While Paddle excels in specific areas like built-in VAT compliance and advanced data security features, Chargebee offers a wider range of features designed to holistically manage and optimize your entire subscription operation. Chargebee’s combined focus on automated processes, self-service capabilities, and advanced analytics empowers businesses to achieve greater efficiency, improve customer experience, and gain valuable insights for data-driven growth.

Pricing and Fees

When choosing a payment services provider, one of the most crucial considerations for any business is costs. Between payment processing rates, platform fees, and additional hidden costs, expenses can quickly pile up. In this section, we examine and compare the pricing models of Paddle and Chargebee.

Paddle Pricing

Paddle offers an all-inclusive, transparent pricing model covering payments, subscription billing, tax compliance, fraud protection, and more under one platform. There are no hidden fees or additional costs.

Their pay-as-you-go pricing starts at 5% + 0.50¢ per transaction, delivering essentials like global payments, built-in tax compliance, chargeback protection, and fraud screening.

Paddle provides customized pricing for rapidly scaling or large enterprises to unlock additional premium capabilities like migration services, implementation support, and dedicated success management.

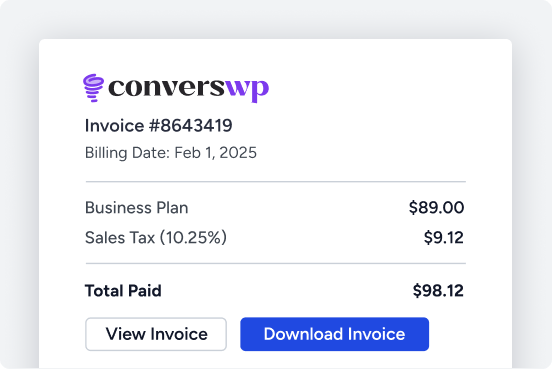

It’s important to note that there are services, Paddle for EDD and Paddle for WooCommerce, that offer customized pricing plans suited for the specific needs of WordPress sites, taking into account transaction volume, subscriptions, and other factors. These services both start at $89/year. For more detailed information visit this link.

Chargebee Pricing

Unlike Paddle’s one-size-fits-all pricing, Chargebee offers a tiered structure catering to businesses of various sizes and needs.

Plan Options:

- Starter: Ideal for launching a subscription model and managing basic features like multi-language support, tax compliance, and dunning. This pay-as-you-go plan charges no fee for the first $250,000 of cumulative billing and 0.75% thereafter.

- Performance: Targets scaling companies seeking revenue optimization and growth. It includes all Starter features with added functionalities like consolidated invoices, multiple payment methods, and automated chargeback management. This plan has an annual commitment with a monthly fee of $599 for up to $100,000 billing and a 0.75% charge on exceeding amounts.

- Enterprise: Designed for established businesses driving continual growth through new products, regions, and pricing models. This customizable plan offers extensive features like account hierarchy, contract terms, multi-entity support, and on-demand discounting. Pricing requires a custom quote obtained by contacting Chargebee’s sales team.

Ease of Use and Support

Selecting a subscription management platform is a critical decision for streamlining your business operations. But navigating the complexities of these platforms can be challenging. This section delves into the ease of use and support offered by both Paddle and Chargebee to help you choose wisely.

Ease of use:

Paddle prioritizes user experience with a clean and intuitive interface. Their straightforward setup process lets businesses get started quickly, even without extensive technical knowledge. Comprehensive documentation and tutorials readily guide users through various functionalities, minimizing the learning curve.

Chargebee, while offering powerful features, might present a steeper initial learning curve compared to Paddle, particularly for users unfamiliar with subscription management platforms. However, Chargebee compensates by providing extensive resources like knowledge base articles, webinars, and video tutorials to bridge the gap. Ultimately, both platforms offer resources to help you navigate their functionalities.

Support Systems:

For immediate assistance, Chargebee shines with its email, phone, and live chat options, providing dedicated support representatives across various channels. This broader range of options caters to users who prefer different modes of communication and require swift solutions. Additionally, tiered support plans offer faster response times and dedicated account managers for higher tiers.

Paddle prioritizes self-service support with readily accessible documentation and a comprehensive support portal empowering users to find solutions independently. While they offer email and live chat support, response times can be within 24 hours, potentially delaying resolution for pressing issues.

Security and Compliance

With payment platforms processing valuable customer data, having rigorous security protocols and compliance with privacy regulations is non-negotiable. We examine how Paddle and Chargebee stack up on key parameters of trust and transparency for customers.

Paddle offers best-in-class security reinforced through adhering to SOC 2, GDPR standards, undergoing regular pentests/audits, and being PCI DSS Level 1 certified – the most stringent level. Their security portal offers in-depth documentation around policies, procedures, recovery metrics, access control, and development practices.

With AWS cloud hosting, role-based access controls, MFA authentication, and advanced threat monitoring via SIEM systems, they check all the boxes for enterprise-grade security. A dedicated security team and proactive vulnerability disclosure program further underpin their mature posture.

In comparison, Chargebee prioritizes security with PCI DSS compliance (albeit Level 2, compared to Paddle’s Level 1), SSL encryption, and input sanitization practices to mitigate common security vulnerabilities like XSS and SQL injection attacks.

While information regarding code audits, access key rotation, and AWS security groups is available, specific details around aspects like penetration testing rigor, container scanning, and network monitoring seem less clear. Providing more extensive documentation outlining their mature security processes could enhance transparency and build trust.

Chargebee’s privacy policy aligns with GDPR principles, ensuring clear expectations around international data handling practices.

Use Cases and Recommendations

With a detailed analysis of core capabilities, security, pricing, and ease of use behind us – we wrap up with recommendations on ideal customer profiles who stand to benefit the most from Paddle and Chargebee’s respective offerings.

Businesses Who Are Best Suited for Paddle:

Given its robust feature set and premium pricing, Paddle shines best for well-established businesses with complex global operations including:

- Mid-market to enterprise SaaS companies earning over $10M+ in revenue

- Gaming studios with 50,000+ users and multi-SKU monetization

- Digital publishers generating high 6-7 figure subscription income

- WordPress-based eCommerce and digital download businesses. Paddle for EDD and Paddle for WooCommerce are tailor-made for these platforms, offering powerful features and seamless integration to help your WordPress site thrive

Specifically, the ability to customize sophisticated subscription billing constructs, executive sales tax calculations across 200+ countries, and tap detailed cross-border consumer spending data make Paddle worthwhile for expanding companies.

Those needing niche accommodations like metered pricing models for API usage, certificate generation for software licenses, or risk management around fluctuating cross-border tax jurisdictions will find that they have unmatched capabilities with Paddle.

Ideal Users for Chargebee’s Platform:

Given its lighter feature set and more affordable pricing, Chargebee suits emerging SaaS, eCommerce, and subscription-based businesses including:

- Startups and small businesses earning up to $10M in revenue

- Companies with straightforward billing needs

- Those wanting basic recurring billing, subscription management, and payment processing

- Users who prioritize ease of use and speed of implementation

- Teams needing to economize their spending as they scale

Specifically, the ability to consolidate billing and payment operations, leverage pre-built integrations with popular apps and APIs, and tap simple analytics around revenue and customer metrics make Chargebee a cost-efficient option.

For straightforward use cases around managing customers, billing cards, tracking subscriptions, and measuring performance – Chargebee reduces complexity. Its smooth onboarding and intuitive interface enable businesses to be up and running quickly.

Summing up….

In closing, both Paddle and Chargebee offer powerful capabilities to streamline billing, payments, and subscription management for SaaS and digital businesses.

Paddle shines with its global reach, built-in VAT compliance, and robust security protocols. It excels at supporting established companies with complex monetization models selling internationally. The integrated ProfitWell analytics and seamless WordPress integrations are icing on the cake.

Chargebee offers unmatched flexibility with tiered pricing plans catering from startups to enterprises. It simplifies workflows with extensive third-party integrations. The holistic focus on automating subscription processes empowers businesses to optimize recurring revenue.

Ultimately, aligning with your business model, target markets, growth stage, and budget is crucial. Assess whether you require advanced global tax tools, seamless WordPress integration, and predictive analytics that Paddle delivers, or if Chargebee’s smoother onboarding, intuitive interface, and ecosystem of integrated tools better suits your needs as you scale.

There’s no one-size-fits-all answer. Carefully weigh the differentiators covered in this comparison to make the right choice for your unique business needs and long-term vision. Partnering with the payment platform that allows you to focus on accelerating growth, not wrestling with recurring billing, is the winning formula.